Legacy Money Live

Risks of Disability

Banking Is Important…

Mortgages and Wealth Transfers

New Year, New Financial Plan

Business Exit Plan – Continuation Strategies for Business Owners

An Introduction to the Infinite Banking Concept

How To Fight Inflation with Life Insurance

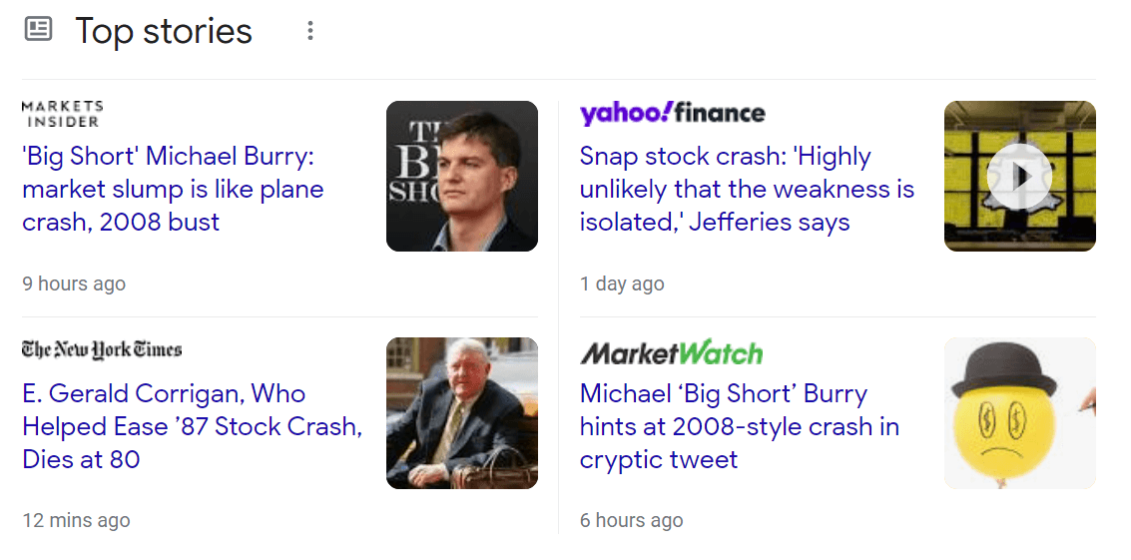

Market Crash?

EVA – Economic Value Added

Infinite Banking Think Tank 2022

IBC the Original DeFi

What is the True Cost of College?

Financial Blog

Welcome to our financial blog. Stay up to date on financial issues. Readers will enjoy financial posts on a variety of topics from saving to tax diversification.

You can increase your knowledge and improve your Financial Intelligence by reading our blog. Read the latest financial news, and learn financial strategies for achieving financial success.

Personal Finance

Personal finance is the process of planning and managing income, expenses, saving, investing, risk and protection. Smart financial management will include a financial plan.

Scroll down for our latest blog and archives.

Our Mission

Our mission is to enrich the lives of families by providing a process for them to maximize their financial security by avoiding the eroding factors of money, and to promote financial intelligence by educating others with specialized knowledge.

Financial Education

Increase your financial education and improve your Financial Intelligence by expanding your knowledge and you will increase your opportunities for success. Reading books and learning from others’ experience is the easiest way to build your knowledge base, check out our bookstore.

VLOG – Legacy Money Video Blog

Legacy Money is our video blog and YouTube channel. The Legacy Money VBLOG is devoted to helping families and business owners protect themselves, plan for the future, and create generational wealth.

Learn more, subscribe to our YouTube channel: www.youtube.com/legacymoney