Whole Life Insurance

Permanent Cash Value Life Insurance

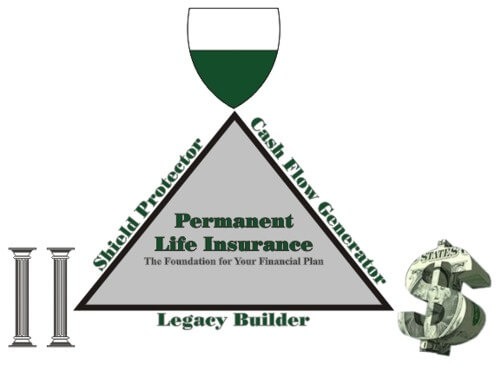

Whole life-insurance provides permanent protection for your entire life while building cash-value and providing significant benefits while you are alive. It is the foundation of your financial plan. Without it, all else can fail.

Are you wondering what to do when it comes to purchasing life insurance? Contact us to learn how permanent, whole-life insurance can benefit you and your family.

Whole Life Insurance Rates

Guaranteed Rates: With true whole life insurance, base premiums remain fixed for the life of the policy. This may not be true with hybrid policies like UL, IUL and VUL.

A part of the premium is used to accumulate a guaranteed cash value thus adding a savings element. Dividends, which are not guaranteed, may also increase policy cash value.

The policy remains in force during the insured’s entire lifetime, provided premiums are paid as specified in the policy.

Whole life insurance policies pay death claims, but they can also provide tremendous economic benefits while you are alive.

When first exploring permanent life insurance, many people first want to consider rates and ask for a quote. However, when you truly understand how you can recover all of your costs and use whole life while you’re alive, rates have little relevance.

Comparing Whole Life to Term

When deciding between whole-life and term, ask yourself if you want to rent or own? In simplistic words, term is like renting and with whole-life you own.

Certain term life policies may be converted to whole life without evidence of insurability during a specified time. This is very important when considering the future.

Learn how whole life insurance can benefit you.

How To Use Your Life Insurance While You’re Alive

Create Your Own Private Reserve with Whole Life Insurance

Did you know that you can use dividend paying, cash-value whole life insurance to create your own private reserve?

You can finance life’s necessities utilizing your own private reserve for banking and financing, so that you never have to depend on banks for money or loans.

Benefits of Owning Permanent, Whole Life, Cash Value Life Insurance

Whole Life Insurance is a very unique and flexible financial planning tool to help you and your family to achieve real financial independence. Properly structured and properly funded Permanent, Whole Life, Cash Value Life Insurance provides you with exceptional benefits.

- Life insurance protects your family with the money they need in the event of your death. It can replace your lost income, pay-off mortgages and pay-off consumer debts, along with paying any medical expenses and burial expenses as a result of your passing.

- Cash value life insurance is a forced savings plan. It forces you to “Pay Yourself First!”

- Cash values accumulate tax deferred, can be accessed tax free and provide tax-free income during retirement. You also have a liquid ‘emergency fund’ for life’s unexpected events, and a private financial system for financing opportunities.

- Life insurance generally bypasses probate, and it is private (no public records).

- Life insurance can be used to pay income taxes on qualified plans and your estate taxes at your death.

- Your base premium is locked in and guaranteed to never increase once approved and issued.

Permanent insurance, provides a living benefit. Part of your premium goes into a cash reserve and accumulates as cash value, tax-deferred.

You can generally access this cash value at any time, for any purpose including emergencies and opportunities. You can also use Life insurance for many other needs like education expenses, retirement income and critical illness.

Life insurance can make your other assets better by providing protection and significant tax benefits. It can also provide a hedge against inflation and the other eroding factors of your money.

Dividends Increase Policy Benefits and Cash Value

Participating whole life insurance is eligible to earn dividends, which can be used to increase the death benefit and the cash value of the policy. Or there are other options you could choose, such as using dividends to help pay premiums.

Mutual life insurance companies have a long history of paying dividends to their policyowners. While there are only a handful of true mutual life insurance companies around, those that are have paid eligible participating policyowners a dividend every year for over a century.

Though dividends are not guaranteed, once they are declared and paid each year, they become a part of total benefit of the policy.

Popular Whole Life Insurance Riders:

Waiver of Premium – The waiver of premium rider typically states that the insurance company will waive the premiums due should the insure become totally disabled. Different companies have different definitions, so you’ll want to verify this when applying.

Critical Illness – The critical illness rider allows the insured to accelerate a portion of the death benefit of the life insurance policy. You can access this benefit early, instead of paying out only upon death, these policy riders provide a benefit if the insured is diagnosed with either terminal diseases or chronic illness that may require continuous care over an extended period. These diseases often include illnesses such as heart attacks, strokes and cancer.

Long Term Care – As an alternative to a separate long term care policy, this rider lets you access money from a part of your life insurance policy during your own lifetime if you are receiving long term care services.

Paid-Up Additional Insurance (PUA) – The PUA rider gives the owner the right to purchase paid-up participating insurance on the insured’s life. The primary benefit of this rider is that it offers premium flexibility, so you can add varying amounts of premium to a whole life policy. The greater the premium paid into a policy the greater the protection afforded by the policy, the greater the guaranteed cash value, and the greater the tax deferred accumulation of cash values and dividends.

Learn How Whole Life Can Benefit You

In summary, the protection and wealth building benefits of whole life insurance make it the most comprehensive financial tool available today. The value is enhanced by the flexibility, which enable it to be customized for your needs.

Premium flexibility is provided by premium and dividend options. The loan feature and the ability to withdraw dividends provide a readily available liquid asset.

Together, the guaranteed cash value, guaranteed death benefit, and guaranteed premium provide a solid foundation for financial protection and the building of wealth in an uncertain world.

We are an independent life insurance agency representing the nation’s most trusted, mutual life insurance companies.