- The money banks loan is not there… or theirs!

- Banks loan MULTIPLES of depositor’s money.

- The money that banks lend is created out of “thin air” without RESERVES.

- Traditional bank lending creates inflation.

- Banks operate on Fractional Reserve Lending.

- FRL allows banks to loan out $10 for every $1 on deposit.

- When money is put into circulation without reserve, this causes inflation.

- Banks profit nearly as much from fees as they do from interest.

- According to BankRate.com and the FDIC, banking and service fees have escalated.

- Check your recent statement for “service”, “ATM” and “FDIC” fees

- Banks are failing at an alarming rate.

- According to the FDIC, there were 18 bank failures just in 2014 .

- Like most federal agencies, the FDIC is broke.

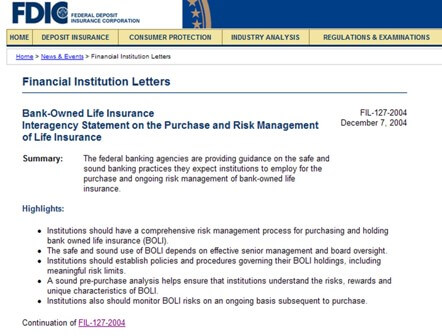

- Banks own a lot of Permanent Life Insurance, called BOLI.

- The FDIC recommends that banks own BOLI (Bank Owned Life Insurance).

- All major banks own BILLION$ in BOLI.

Now that you know the Secrets the Big Banks Don’t Want You to Know you can make intelligent decisions about your finances.

So, why would you want to turn your hard earned money over to someone else’s bank? When you learn how to become your own banker, you can escape the enticement of the banking monopoly and build your own wealth.

To learn more about banking and how you can utilize it in your life, follow this link and download our free report: Discover Infinite Banking

Stop paying interest and fees to the BIG Banks. Fire your banker and take control of your finances! Request an IBC Review today, follow this link: http://legacyinsuranceagency.com/ibc

Until next time,

Barry Page, RFC

IBC Authorized Practitioner

If you enjoyed the post, please comment, share and let me know!

Barry Page, RFC is recognized as a leading expert on finance, life insurance and private banking. He is a financial consultant and independent life insurance agent who helps clients with tax advantaged investment alternatives. He specializes in showing families how to protect their assets, income and lives utilizing a macro-financial approach to planning.