Discover How To Become Your Own Banker

You can learn how to become your own banker by simply reading and thinking. BYOB has been an acronym for many phrases over the years, but my all-time favorite is Becoming Your Own Banker ©, the bestselling book from, R. Nelson Nash.

In the book, Nash explains how to become your own banker using the concept he created, the Infinite Banking Concept © (IBC). This unique strategy teaches ordinary people how to break free from the banking industry, and recover the interest and fees they would normally transfer away.

Let me make it abundantly clear—I am not talking about a bank in the conventional sense of the word. I am demonstrating that one can use dividend-paying whole life insurance to solve one’s need for finance throughout one’s life.

Nelson Nash

The book details the truth about Dividend-Paying Whole Life Insurance that the commercial banks use themselves to store and protect their wealth. It’s a real paradigm shift from what we’ve been taught about banking and money.

How To Become Your Own Banker

Becoming Your Own Banker© is the textbook for a ten-hour course of instruction on the power of dividend-paying whole life insurance. It is financial education that the life insurance industry has failed to teach consumers.

Most anyone can take control of their finances and become their own banker, if they are willing to open their mind to a different way of looking at life insurance.

Human Problems

The Arrival Syndrome – I already know everything, so there is no point trying to teach me something new.

Nelson Nash, Becoming Your Own Banker©, 5th Edition page 34.

The Book is a Course of Instruction Financial Education

Unfortunately, the insurance industry as a whole has concentrated on the death benefit of life insurance, neglecting to adequately describe the financing capabilities of the contract for policy owners. Who wants to talk about dying?

The book, Becoming Your Own Banker©, demonstrates that our need for finance over our lifetime, is much greater than our need for death protection. If we can solve for both “needs’ through one financial instrument, then we’ll end up with a better solution.

Creating Your Own Banking System

Most everyone understands that you can borrow against the cash-values of a whole life policy, but because most pay very small premiums or opt instead for low cost term insurance, there have limited access to money for financing.

If we instead consider how much we finance during a lifetime, and try to focus on accumulation of our personal capital for financing, then the equation becomes easier to solve.

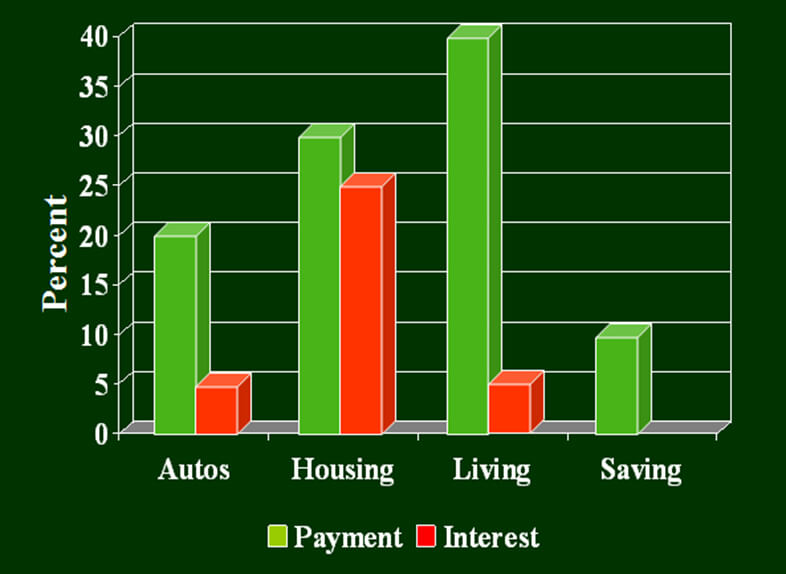

Take a look at this chart on the Annual Pattern of Spending compared with interest paid on each category. It illustrates the spending habits of the “All American Family”.

Becoming Your Own Banker©, 5th Edition page 17.

Looking at the chart, notice how the interest paid (red lines) amounts to 34% of every dollar spent. And, it has nothing to do with the rates, it’s the volume.

The Problem

The problem is all of these items are financed by other banking institutions, and once the money is spent, it is gone forever!

This means that the interest portion of every dollar spent is perpetual.

The volume of interest is the real issue, not the annual percent rates.

Banks -vs- Insurance Companies

Fractional Reserve Banking, as dictated by the Federal Reserve, holds the American people in bondage.

Fractional reserve requirements are the amount of funds that commercial banking institutions must hold in reserve against specific deposit liabilities.

Fractional-reserve banking occurs when the bank lends or invests some of its depositors’ funds and retains only a fraction of the deposits in cash. This cash is the bank’s reserves. Hence the name fractional-reserve banking. All U.S. banks today engage in fractional–reserve banking.

Fractional Reserves and the Fed – Joseph T. Salerno

The Real Cause of Inflation

Most people are astonished to find out that commercial banks are only required to hold a cash reserve of 10% against their deposit liabilities. The deposits represent the bank’s liabilities, their contractual obligation to redeem them on demand.

Fractional-reserve banking creates inflation. When a bank lends multiples of its’ customer’s deposits, it inevitably expands the money supply.

A fractional-reserve bank really on remains solvent as long as public confidence exists. If customers have the faintest suspicion that a bank’s deposits are no longer payable on demand, the bank’s reputation could vanish overnight.

Reserve Requirements

Insurance companies must put the premiums they receive to work in various ways in order for them to pay the death claims.

Insurers must hold a portion of their assets as either cash, or capital assets, so that they will be able to make good on their claims in a timely manner.

Insurance companies are required by state law to meet reserve requirements, called statutory reserves. These reserves vary depending on the type of insurance, and they are generally regulated by The National Association of Insurance Commissioners (NAIC).

Some insurance companies hold additional capital above their statutory reserve requirements, often referred to as non-statutory reserves or voluntary reserves.

Mutual Life Insurance

Infinite Banking works through the use of participating, dividend paying whole life insurance, issued by a mutual life insurance company.

Mutual life insurance companies have always been few in number. They differ from stock insurance companies in many ways.

Private Mutual Company

• Owned by Policyholders

• Pay Dividends to Policyholders

• Not publicly traded

• Dividends are NOT Guaranteed

(100+ years of paying to policyholders)

Public Stock Company

• Owned by Stockholders

• Pay Dividends to Stockholders

• Stocks offered to public to raise capital.

• Dividends are NOT Guaranteed

(paid to stockholders)

Why Haven’t I Heard of This Before?

The Banks and Financial Institutions do a good job of confusing things…. And, they DON’T WANT YOU TO KNOW.

You can start your own “bank” by taking control of your finances, and creating your own private system for finance, based on self-reliance and personal capital.

How Much Does it Cost?

Once you understand that you can literally spend all of the money that you’ve accumulated, cost is not a factor. It becomes fun!

Imagine being able to USE and SPEND your life insurance while you are alive! AND, leave a legacy of financial stewardship to your heirs.

Nelson always said, “Wealth must reside somewhere.” And, what better place is there to have it reside, than in a private contract that you own and control?

Would you like to learn if Infinite Banking is right for you? Follow this link to schedule a discovery call.

Until next time,

Barry Page, RFC

IBC Authorized Practitioner

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps families take control of their finances and create financial independence.

Page has been cited on ABC, CBS, NBC and FOX for his work helping families and businesses with wealth building strategies to increase cash-flow, secure capital financing and provide tax-free retirement income.

Subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Follow us on Facebook:

https://www.facebook.com/legacyinsuranceagency