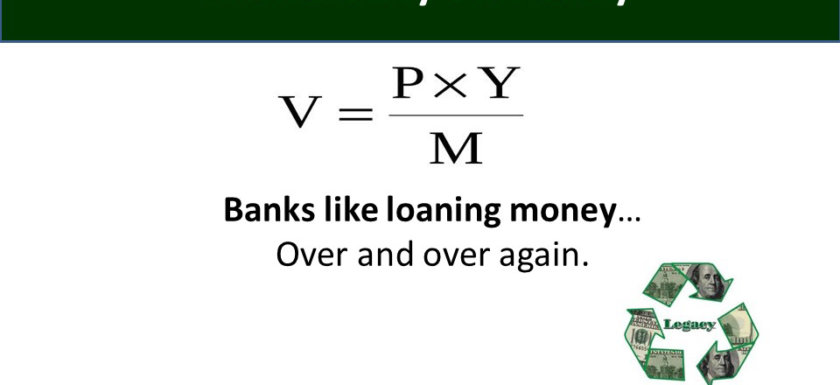

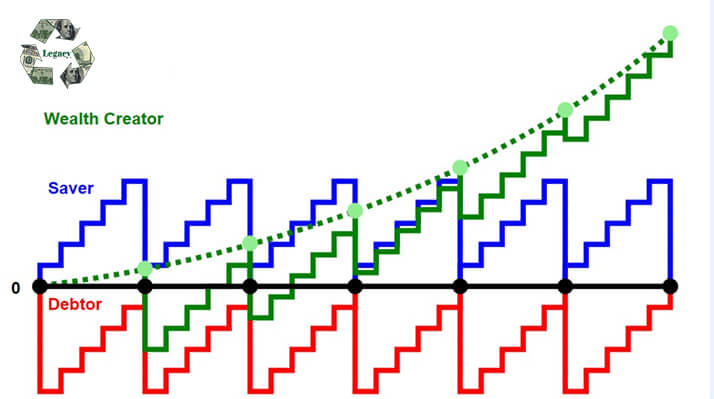

Do What Banks Do

Do What the Banks Do –

Nelson Nash, said “Banking is the most important business in the world.“

We have to start thinking like bankers.

Banks make money using other people’s money (OPM).

Infinite Banking allow us to finance our purchases without bank rules.Read More →