Your Greatest Asset

Your Greatest Asset

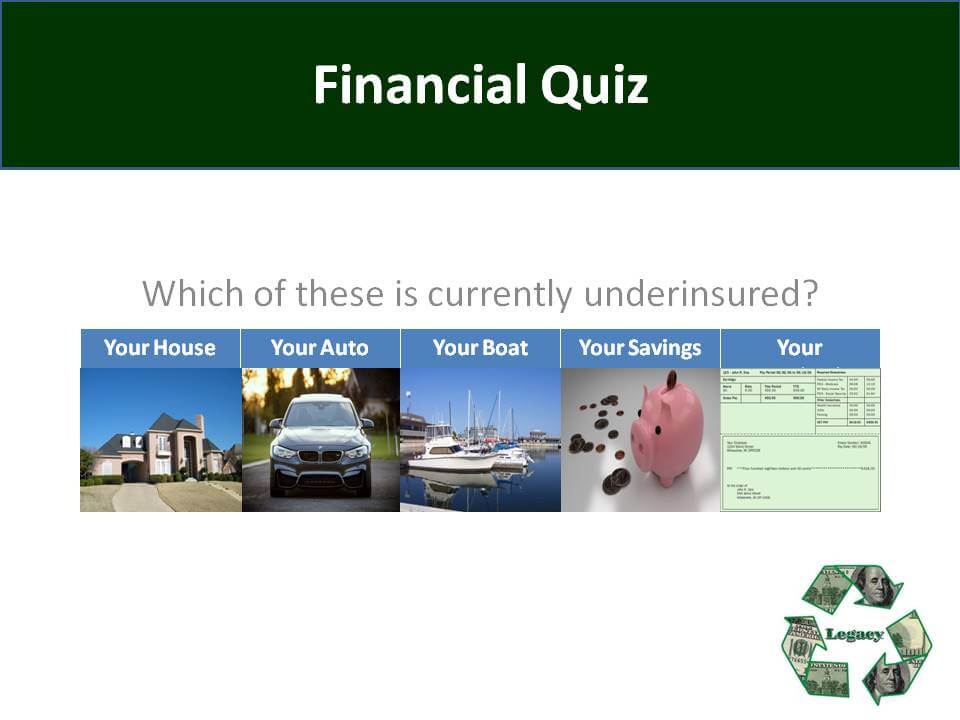

Your ability to earn an income is your greatest asset. If that income is interrupted… even for a brief period… What would happen to your lifestyle?

Most people understand the need to insure themselves from theft, fire and the risk of death… But too often they are leaving an even greater risk totally unprotected, the risk of disability.Read More →