Banking is the most important business in the world.

R. Nelson Nash

But the question is, who’s in control of the banking function in your personal economy?

Seriously, who’s really in control of your money?

When you consider where you store your capital, you should strive for an account that offers liquidity, use and control.

Bank Storage

We store our money in the bank for many reasons, but primarily it’s for security and convenience. No longer are CD’s or savings accounts considered growth vehicles.

Often touted as “Insured by the FDIC”, banks make us think our money is safe with them. After all, they store it in a “safe”. We assume that money in the bank is safe and will be there when we want or need it.

The big banks make it real easy for us to store and deposit our income with them. But, the problem is, once it’s there… it’s theirs!

The Dodd Frank Act and Bail-Ins

Thanks to the Dodd Frank Act, when you turn your money over to the bank as a deposit, you are giving the bank your permission to use it while on deposit.

The Dodd-Frank act, supposedly created to protect the taxpayers, now precludes the federal government from any future bailouts of “systemically important financial institutions” (SIFIs). In short, those that pose risk to the overall financial system. Bailouts have now been replaced with the possibility of bail-ins.

With a bail-in, creditors and shareholders will bear the losses rather than the taxpayers. But creditors and accountholders are one and the same, so many Americans could be wiped out with a bail-in.

The FDIC and Ratings

According to the FDIC, and a co-authored document with the Bank of England, “Resolving Globally Active, Systemically Important, Financial Institutions”, IOUs will be converted into “bank equity.” The bank gets the money and the depositor gets stock in the bank. Here’s the link to the FDIC document.

If the bank’s IOUs are converted to bank stock, the depositer will no longer be subject to insurance protection by the FDIC, but will be “at risk” and vulnerable to being wiped out, just as the Lehman Brothers shareholders were in 2008.

So, while your cash in the bank may still be available for your use, the money in your account essentially becomes an unsecured debt obligation. Making the depositer, technically and legally, an unsecured creditor of the bank.

Fed Stress Tests

For some additional context, the standard deposit insurance coverage limit is $250,000 per depositor at FDIC-insured banks. Anything up to that amount is insured. However, any amount above the $250,000 threshold that isn’t separately insured, is not protected from bank runs. Under the Dodd-Frank Act, a bank is considered “well capitalized” if it has a Tier-1 ratio of 6%.

The Fed’s stress test, however, assessed whether banks would stay above the required 4.5% minimum capital ratio during the hypothetical downturn.

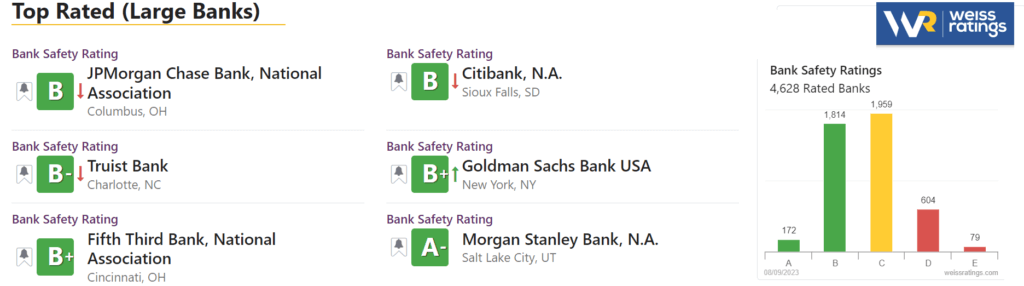

According to Weiss Ratings (a leading provider of 100% independent grades on stocks, mutual funds, financial institutions and cryptocurrencies), the 4.5% is a pretty low threshold; and it overlooks deposits.

All the Fed really cares about are the current reserves in these Tier-1 Banks, and if they can absorb the losses while maintaining minimum requirements.

At Weiss Research, they follow the more strict Basel III guidelines, they use 8% as a barometer. For comparison, Silicon Valley Bank (SVB) only had an adjusted ratio of equity capital to total assets of 5.8% as of Dec. 31, 2022.

Why Banking is Important

Now, you may be thinking, “I don’t have more than $250K in the bank, so it doesn’t matter.” Well, there’s another issue…

Banking is important to our economy and to our livelihood. Our money is constantly being exchanged and moved around in the form of deposits and transactions within the banking system.

But, there’s a problem.

According to the FDIC website, at the end of 2017 the FDIC’s Deposit Insurance Fund (DIF) had $92.7 Billion to insure total insurable deposits of $7.1 Trillion. That means the FDIC only had enough funds to protect 1.3 cents of every dollar of insured deposits.

How would you feel if you were only able to get $0.013 cents for every $1 that you had deposited in the bank?!!! If only one of the major banks fails, it could wipe out the entire DIF.

We finance everything we buy, so learning to control the banking function is of utmost importance.

Uninsured Deposits

There’s even more caution throughout the banking industry. It was also reported that 16 companies restated uninsured deposits by at least $1 billion in either Q4 2022 or Q1 2023. Huntington National Bank’s restatement on its Q4 2022 call report was a large decline of 39.9%, and the largest by percentage. In dollar amount change, Bank of America (BAC)’s downward adjustment of $125.34 Billion in uninsured deposits leads the way.

On the flip side, BancFirst’s restatement was a staggering 93.5% larger on uninsured deposits … which is not a good look. It is also a poor reflection on its auditing and accounting team. Now, this is not to say it’s a bad bank overall, as it actually has an “A” with Weiss Ratings.

One of the major reasons for these massive adjustments is how banks are classifying their “intercompany deposits.” Intercompany deposits are held by one member of a company for another in a sort of “consolidated structure,” like cash of a holding company with its bank subsidiary. In other words, it seems banks are trying to see which accounts are really insured and which ones aren’t. If that’s the case, it is actually a great reason for these adjustments.

Tier 1 Capital and Bank Owned Life Insurance

One of the most important gauges of a bank’s health is its adjusted Tier-1 capital ratio distributions. This metric determines if a bank holds enough capital to prevent insolvency.

Where do you think banks keep their Tier 1 Capital?

Tier 1 Capital is often stored in something called BOLI, Bank Owned Life Insurance. You see, the big banks own and use permanent life insurance contracts themselves… but they don’t want to tell you.

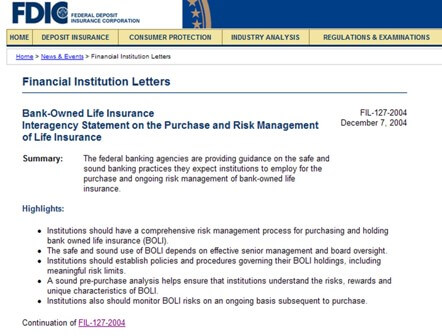

Banks understand that life insurance is a safe place to store capital. Even the FDIC recommends that banks own life insurance as a part of their risk management, and they own lots of it.

Fractional Reserve Lending

But, the banks would rather you keep your money with them, so they can loan it back out to you and others. Banks use a system called fractional reserve lending, so they can loan out up to 10 times what they have on deposit.

Under this fractional reserve system, banks can literally create money out of thin air. The adverse effect is inflation, which is basically a tax placed on us by the Fed as banks inflate their money supply and we are forced to pay higher prices for goods and services. This is exactly what’s happening right now in our economy.

The Good News About Banking

The good news is, you can create your own private banking system, and combat the losses associated with tradional lending. When you own a properly structured life insurance contract, built with the Infinite Banking Concept (IBC) in mind, you are in control of the banking function and therefore can finance your own purchases.

Let that sink in… Once capitalized, you can finance your own purchases, so you never have to depend on traditional banks for lending. With no credit scoring or further lending requirements.

That means you have liquidity, use and control of the account. The policyowner has access to the cash-value in the policy at any time for any reason via loans or surrenders. Along with the security of a mutual life insurance company that is owned by the policyholders.

Only a handful of the best carriers are mutual companies and have a 150+ year track record of paying dividends every single year to the policyowners. This makes them ideal for IBC, they have a long term view and are in the business of being profitable for the policyholders.

Liquidity, Use and Control

So, when you consider where you store your hard earned money, you should strive for an account that offers liquidity, use and control. The added security of a legacy death benefit, and the banking function that is inherently built into permanent life insurance, make it the ultimate place to store your capital. And, the growth, income and death benefit are all tax-free.

I don’t have to tell you that things are changing rapidly in our society. Now is the time to take control of the banking function in your life. Do it now, while you can.

Why not find out how adding whole life insurance to your financial plan can help reduce costs and stress, giving you financial peace of mind, and control of the banking function in your life? Get Started Here!

Until next time, I’m your financial advocate!

Barry Page, RFC

IBC Practitioner and Coach