Family Banking Master Class

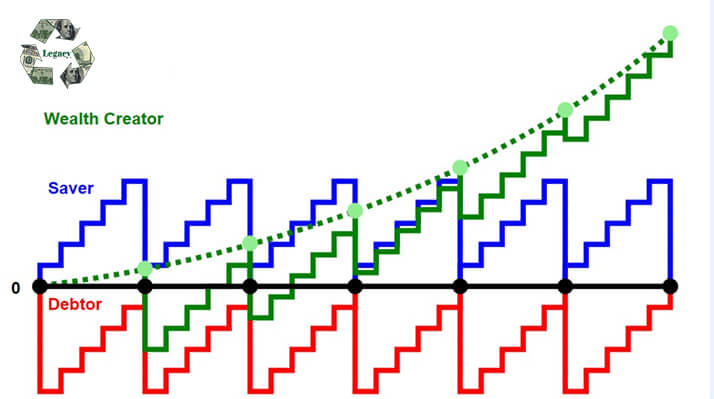

Family Banking Master Class – Video Training on Demand DISCOVER How To START A Family Bank and STOP Depending on Banks Forever Learn How Private Family Banking Works Learn how to start your own famiy banking system in this short video masterclass that you can watch instantly, on demand. You’ll learn how to finance your major purchases through your own private financial system, without credit reporting and bank qualifying. Video Training Based On IBC Family banking is a simple way to protect and grow your wealth safely. The Infinite Banking Concept™ (IBC) as detailed in the book, Becoming Your Own Banker™ is simplified and explained in ourRead More →