College Tuition Costs

How To Pay for College

College tuition costs are growing at a significant rate. Paying for a child’s or grandchild’s college education tomorrow requires forward thinking and planning today. Keep reading and learn how to pay for college in the most effective way.

In the past five years, the average inflation-adjusted cost of tuition and fees has risen by 27% at public four-year colleges and 14% at four-year private colleges. This has left the average yearly cost for a private four-year college at $30,094.1

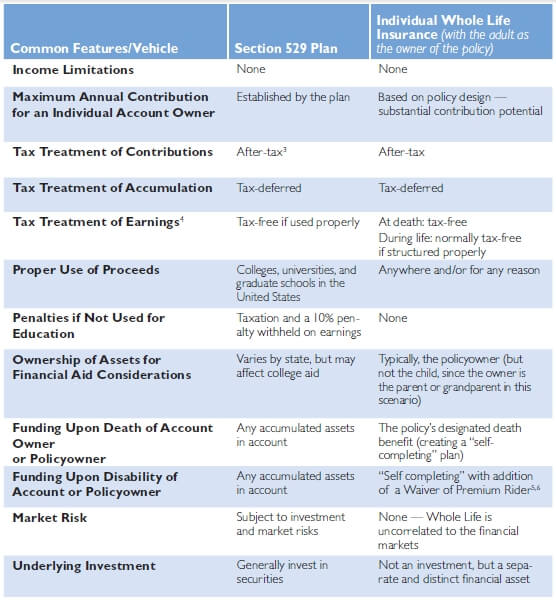

How should parents or grandparents save for tomorrow? Let’s examine two ways these adults can save for a child’s college — education: a Section 529 Plan and another lesser-known alternative — permanent, participating Whole Life insurance.2

Key Considerations When Funding a Section 529 Plan

1. What if the child does not attend college? The growth on the money could become taxable and subject to

potential penalties if it’s withdrawn for other uses.7

2. The money in a 529 Plan is subject to loss due to investment and market risk.

3. 529 Plans are not “self completing,” should a parent or grandparent die or become disabled prior to complete

funding.

4. 529 Plans have funding limits (per beneficiary / per person). For example, in 2015, the $14,000 annual

federal gift tax exclusion is in place and will be indexed for inflation (although they can be super-funded in

year one by contributing the first five years’ worth of gifts in a lump sum).

What’s your risk tolerance when funding your child’s education?

For many, that can be a difficult question to answer. Typically, because of the short time frame, it shouldn’t be as

aggressive as your retirement funding. And many just want to be sure the money will be there when the college finance department starts sending the bills.

Top Reasons to Include Whole Life Insurance as a College Funding Option:

1. The life insurance policy can become self completing in the event of a premature death or disability.

2. The gains within the policy are “locked in” versus being subject to investment market fluctuations.

3. Tax-favored access to cash throughout the policyowner’s life.

4. Eligibility for financial aid is typically not affected by the existence of a life policy.

5. The policyowner is in control of the assets instead of the child, as is the case in some other asset ownership

saving options, such as UTMAs or UGMAs.

6. The policy’s cash value can start building before your child is born.

7. Whole life insurance does not have to be designated to a single child’s educational goal. It’s also a flexible cash

resource you can use for any other future financial objective.

8. Outside of the actual policy design, there are no contribution limit restrictions set by the IRS.

9. Unlike some education savings plans, there are no set income restrictions (except for insurable interest considerations in the underwriting process).

College Tuition Costs

Learn more here: https://collegecost.ed.gov

Remember

Life insurance can be used in conjunction with other popular college savings options. And since the life policy has

multiple uses, it may help you fund other long-term financial goals, such as retirement. As previously stated, the age of the child you are saving for will help drive how you use various financial instruments.

Please note: Past performance isn’t indicative of future returns.

7 Some states allow excess funds to be used in other ways. Please check with your state’s plan for specifics.

If you need help on how to reach higher education or any other type of long term financial objective, please contact us to see what makes sense for your situation. College tuition costs continue to rise and now is the time to plan. The sooner you start, the more you can save.

Start Saving for College Today!

Barry Page, RFC

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps clients with tax-advantaged investment alternatives, and specializes in showing families how to protect their assets, income and lives utilizing a macro-financial approach to planning.

1 The College Board, 2013-2014 Annual Survey of Colleges; NCES, IPEDS.

2 In addition to protection, Whole Life insurance can create a long-term accumulation product. Whole Life Insurance provides death benefit protection and guaranteed cash values for the whole of life as long as the required premiums are paid. Costs for these benefits are reflected in lower cash values in the early years

of the policy. When a consumer uses the product for these purposes, they should have an adequate time horizon in order for the cash values to grow. The age of the child should be a consideration in the eventual savings strategy chosen Whole life guarantees are based on the claims paying ability of the insurance company.

3 Contributions to 529 Plans are state-tax deductible in some states, although to get the nominal deduction, the state may require the investor to use that state’s specific plan. Check with your state to determine availability.

4 Guardian does not give tax advice. Please consult your own tax advisor or attorney for issues related to your own situation.

5 Some riders are available at an additional cost.

6 Waiver of Premium riders, when added, for an additional premium, can create a policy that pays for itself when the insured has a qualifying disability (rider form 01-R2).

Much of this post was first published by The Guardian Life Insurance Company of America (Guardian) Pub 4941 (02/15) 2015—1707 https://www.guardianlife.com

The Guardian Insurance & Annuity Company, Inc (GIAC), a Delaware corporation whose principal place of business is 7 Hanover Square, New York NY. 10004. GIAC is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian), New York, NY.

Legacy Insurance Agency, PLLC and Barry Page, RFC are independent insurance agents. Legacy Insurance Agency, PLLC is not an affiliate or subsidiary of Guardian.