Compound Interest

In today’s Tuesday Tip, we are going to talk about compound interest. And, specifically uninterrupted compound interest or uninterrupted compounding.

This is really important stuff, as a matter of fact, probably the world’s most known scientist, Albert Einstein is said to have once described compound interest as “the eighth wonder of the world”. “He who understands it, earns it; he who doesn’t, pays it,”

Financing with Compound Interest

We are actually going to TURBO CHARGE that thought and discuss it in terms of financing, not just in earning.

The very first principle that you must understand is…

“You finance everything you buy. You either earn interest, or you pay interest.”

Nelson Nash

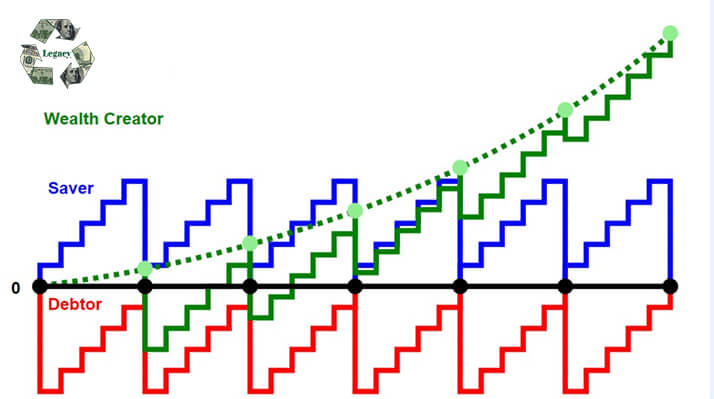

Typically we save now in order to spend later, or to create future income.

Every dollar not saved is consumed by transfers and lifestyle. Before any capital outlay, before you spend any money, you first should consider the cost. And, the lost opportunity costs.

When you access the saved money, that is earning interest, you interrupt the compounding.

Why not use a savings vehicle that allows for uninterrupted compounding?

Uninterrupted compounding means that your money is available and liquid, yet it continues to grow even while being used.

As far as I know, there are only…

3 Financial Instruments that Allow for Uninterrupted Compounding.

- Real Estate

- Margin Accounts

- Permanent Life Insurance

The major difference in all of these is, only Permanent Life Insurance (PLI) offers guaranteed growth. And, if used correctly, the growth on PLI is tax free.

Uninterrupted Compound Interest

What could be better than compound interest? Uninterrupted compound interest means your asset continues to grow even when being used.

You can earn uninterrupted compound interest for the rest of your life, and utilize your capital for other things.

You can earn compound interest while making purchases or for other investments.

Buy your vehicles, buy real estate, trade stocks, and invest in private placements, and start a business, or any profitable activity that you want.

By financing major purchases through their own plan, the average family can increase their wealth by $500,000 or more over a lifetime.

Learn how to take control of your money, schedule a personal financial review. Just follow this link and book your consultation:

Until next time,

Barry Page, RFC

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps families take control of their finances and create financial independence.

Page has been cited on ABC, CBS, NBC and FOX for his work helping families and businesses with wealth building strategies to increase cash-flow, secure capital financing and provide tax-free retirement income.

Please subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Find us and “like us” on Facebook:

https://www.facebook.com/legacyinsuranceagency