Do What Banks Do

So, what do banks do? And, how do banks make money?

Banks make money using other people’s money (OPM).

“Banking is the most important business in the world.”

Nelson Nash

We have to start thinking like bankers…

Most people understand that banks loan money and charge interest and fees to do so. But, when I ask people how that works, things get a little fuzzy. Typically if people respond, they say that it’s on the spread between what they charge and what they pay as interest. And, that is true, but there’s much more to the story.

Banks are in the business of making money… Literally.

Here’s the dirty little secret. Banks can loan more money than they have on deposit. And, by doing so, they are literally creating money out of thin air.

You can read my many blogs and posts on the Federal Reserve on our website to learn more about Fractional Reserve Lending. For a deeper understanding, read Murray Rothbard’s classic, The Mystery of Banking and Building Your Warehouse of Wealth from Nelson Nash.

Where Do Banks Store Their Money?

It’s more than ironic when people discover where banks store their Tier 1 Capital. They don’t follow conventional wisdom when it comes to protecting themselves from risk.

The vast majority of banks in the United States follow the FDIC’s recommendation to own BOLI or Bank Owned Life Insurance. BOLI is a tax favored asset that commercial banks own to offset risks and for financing employee benefits.

A banks tier 1 capital represents its equity and reserves. It is the core capital that measures their financial strength. Banks utilize BOLI because it is safe and can produce better results with less risk than they could otherwise achieve.

Interest and Fees

Banks charge interest on loans they make, and consumers happily pay it for the convenience to purchase on credit. Few people have the discipline to save first and pay for their purchases. But, even those who do pay cash with their savings are then “killing the goose that is laying golden eggs.”

We save our money in accounts or assets that we hope will produce a return, but once the account is emptied the money is no longer earning a return.

In his book, Becoming Your Own Banker, Nelson Nash makes it abundantly clear that we finance everything that we buy. We either pay interest to someone else for the use of their money or give up the ability to earn interest otherwise.

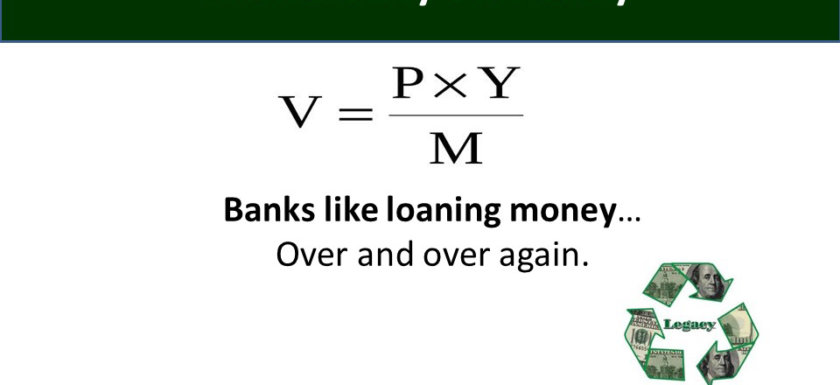

While financial institutions like to confuse us with ever changing interest rates, it’s the volume of interest that we pay over time that makes all the difference.

You may have wondered how banks earn money on debit cards since you don’t normally don’t pay interest or fees. Well, the merchant pays the fees in this case. And, if you use an ATM that is not your bank’s or in their network, you may have paid this fee yourself.

Bankers understand that $2-$5 isn’t really enough to upset most people, so most will never question the fee. But, when you realize that a $4 fee on a $40 ATM withdrawal is 10% just to have access to your own capital, then it’s easy to understand that fees can add up quickly.

How To Take Make Money Like The Banks Do

Now that we understand that banks money by leveraging deposits and charging interest over and above their costs, we can use that same strategy.

Obviously a family bank is not a bank in the sense of a business with a location and employees. However, if we think of our family’s finances as our own personal economies, then we can start to understand how we could use the same principles they do.

Infinite Banking is a predictable way to create financial freedom using your own personal capital. By practicing the Infinite Banking Concept™ (IBC), you can grow your family’s wealth safely and predictably.

IBC allows families and businesses to finance major purchases through their own “bank” without depending on financial institutions thus eliminating the need for credit reporting.

We can learn from banks in these ways.

- Store capital in a safe place

- Avoid risk by holding safe assets

- Think long-term resisting short term speculation

- Life insurance offers tax advantages and other living benefits

- Utilize leverage when loaning other people’s money OPM

- Practice and understand the Velocity of Money

If we can start to think like bankers and first protect our money from loss, then we can leverage it to do other work. By collateralizing our accounts, the money continues to grow while we use OPM to fund our major purchases. And by repaying the loans, just like we would do with the financial institutions, we can recover those payments to use over again.

By again thinking like a bank, if we utilize our proceeds for business and worthy investments, then we can profit from those.

Taxes are another issue that we can help to offset by thinking like bankers. And, although certain assets may produce larger returns than others, net after tax income is really the bottom line.

Hopefully this has been helpful to your understanding of banking and how it works.

So, until next time,

I’m Barry Page, LIFE Evangelist

IBC Authorized Practitioner and Mentor

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps families take control of their finances and create financial independence.

Page has been cited on ABC, CBS, NBC and FOX for his work helping families and businesses with wealth building strategies to increase cash-flow, secure capital financing and provide tax-free retirement income.

Please subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Find us and “like us” on Facebook:

https://www.facebook.com/legacyinsuranceagency