Don’t Steal the Peas!

Rules for The Infinite Banking Concept™ (IBC)

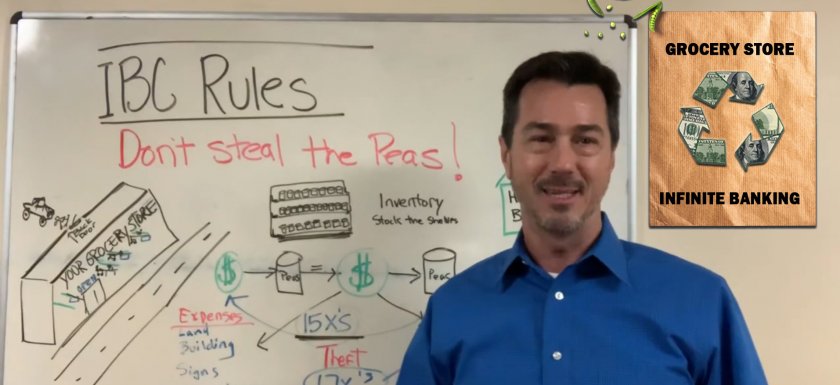

Don’t Steal the Peas!

Nelson Nash

When people first hear the phrase, “Don’t Steal the Peas” they often chuckle. But the grocery store example has real meaning for those practicing Infinite Banking (IBC), and trying to be an honest banker.

In his bestselling book, Becoming Your Own Banker™, Nelson Nash shares an exercise with his readers. In this enlightening story, Nash compares banking to operating a grocery store.

The Grocery Store Example

Everyone consumes groceries, so the thought is that everyone is also a potential customer of the grocery store. Family members could also be considered “captive customers”.

In the Grocery Store exercise, we are supposed to imagine going into business, with all of the real world things that are necessary to be successful.

Operating a grocery store takes time and expense. Nash describes the acts of locating real estate, buying equipment and stocking the store. And, restocking the store shelves takes time and expense too.

When describing the objective of a business, Nash refers to eventually selling the business to provide “retirement income”. This is one of the few times Nelson discusses retirement, he typically referred to it as “passive income time”.

Later in the exercise, he complicates the story by describing the typical mindset of most young business owners.

When shopping for groceries at your store, your wife comes in the “front door” and fills up her shopping cart. Nash asks, “Out of which door is she likely to take the groceries, front or back?”

This is the predicament business owners have to face, pressure from friends and family to get “free” or discounted items. He politely describes this as theft, and further discusses the “hired help” witnessing the wife taking groceries, and wanting to do the same.

In the Grocery Store exercise, we are supposed to imagine going into business, with all of the real world things that are necessary to be successful.

Operating a grocery store takes time and expense. In his book, Nash describes the acts of locating real estate, buying equipment and stocking the store. And of course, restocking the store shelves after selling inventory takes time and expense too.

Check out this video, “Don’t Steal the Peas!”

Becoming an Honest Banker (IBC)

Now that you have a better understanding of business and what it takes to earn a profit, let’s relate that to banking.

Banks are in business to earn a profit, just like other businesses. And while few can relate to actually making money with other people’s money (OPM), we’ll keep it simple like the grocery store.

Banks can not make loans unless they have deposits (peas). They do not lend their money, they lend the money that depositors have left there. So, they have to be prudent in managing the loans and deposits.

There have been massive bank failures over the years. In his book, Becoming Your Own Banker, Nelson tells the story of the First National Bank of Midland, Texas (the richest city in America per capita during the mid 1980’s).

The bank had a large loan portfolio of $1.5 Billion, and 26% of the loans were non-performing, meaning they weren’t being repaid. Many of these loans were made by the bank’s board of directors.

They were making loans to themselves to invest in the booming oil business, but were not repaying the loans. They were not being “honest bankers”. Had they only repaid their loans with interest, their bank would have stayed in business, but greed did them in.

Creating A Bank

In order to start a traditional bank you will need capital. You will need a Bank Charter, and you will need customers to deposit money in your bank. You will need to do a lot of advertising to convince people to deposit their money in your bank.

The bottom line is, it will take a lot of time and money to create your own bank the traditional way. But, you can forego this time and expense by learning from banks, and Becoming Your Own Banker.

The Cost of Acquisition

In the world of finance there is an important term, the cost of acquisition. Most people never recognize this when it comes to finance, even small business owners. They understand that the purchases they make have a cost, but they don’t recognize the time and expense that went into making the purchase.

The cost of financing is in addition to the cost of the purchase. And, when you factor in the lost opportunity costs on the money that’s not working, the costs of acquisition only increase.

If you are in command of the banking function, you can eliminate the cost of acquisition. The Infinite Banking Concept puts you in control so you don’t have to go through this erosion of your wealth.

Infinite Banking takes time, discipline and commitment. It also takes capital to get the system started. And, if you take groceries out the back door without paying for them, you will likely go bankrupt.

Don’t Steal the Peas

Hopefully the grocery store example has been enlightening and helpful to your understanding of infinite banking and how it works.

If the bank and the grocery store are subjects you can relate to now after having heard the story, perhaps you’re ready to start banking on yourself.

If you want to know how you can use Infinite Banking in your family life or business, schedule a time for us to talk. Just follow this link to learn more and schedule a meeting: https://legacyinsuranceagency.com/ibc

Until next time,

I’m Barry Page, Your LIFE Evangelist

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps families take control of their finances and create financial independence.

Page has been cited on ABC, CBS, NBC and FOX for his work helping families and businesses with wealth building strategies to increase cash-flow, secure capital financing and provide tax-free retirement income.

Please subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Find us and “like us” on Facebook:

https://www.facebook.com/legacyinsuranceagency