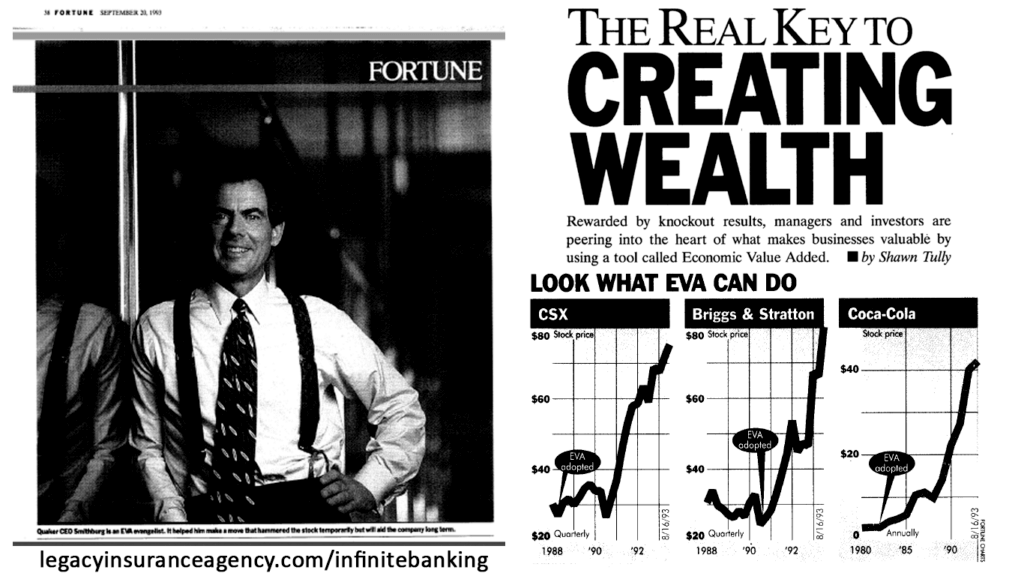

Economic Value Added (EVA), as detailed in this Fortune – September 1993 article, is “The Real Key To Creating Wealth”

Shawn Tully described the concept of EVA, developed by Stern Stewart & Co. of New York, as the leading idea in corporate finance at the time.

EVA and IBC Can Increase Profits

The Infinite Banking Concept (IBC) shares the same philosophy. And it’s creator, Nelson Nash, says Economic Value Added (EVA) may have been the most talked about, but it was far from the newest.

The idea of earning more than the cost of capital is probably the oldest idea in business. And, just as the glory days of Greece were forgotten, so too was the concept of EVA.

Corportate managers, accountants and investors often think they’ve been introduced to a revolutionary idea when they first discover EVA, but it’s only because they’ve been blinded by the noise.

Learning from EVA – Your Capital Has a Cost

Before being introduced to Economic Value Added, corporations were borrowing capital and paying interest to others, while treating their personal capital as if it had no cost. Once they recognized the problem, and conducted their business with EVA in mind, their profits increased dramatically.

“EVA’s basic premise is–if you know what’s really happening, you’ll know what to do. The same thing applies to the Infinite Banking Concept.”

~Nelson Nash, Becoming Your Own Banker, 5th Edition pg 21

Lost Opportunity Costs

The alternate use of money, often referred to as opportunity cost, is a basic principle of finance. We have to deal with the fact that our personal capital has a cost.

If you lose a dollar to interest, fees or any other expense, that dollar is gone forever. It will never work for you or your family again.

In reality, not only do you lose the dollar, but you lose the opportunity for that dollar to earn interest in the future. The compounding of capital is interrupted when it is spent, therefore capitalization must restart, this is the cost. I discuss the power of uninterrupted compound interest in detail in this episode of LegacyMoney.

How It All Works

Life insurance companies hire actuaries, attorneys to calculate costs and determine profitability over a long period of time, typically 100 years. They work similar to engineers developing private contracts for individuals and families (policyowners).

The companies hire an administrative staff and sales forces to sell and maintain these contracts. To simplify things, the life insurance company manages the business, and policyholders participate in the profits.

Discover The Alternative To Investing

The Infinite Banking Concept teaches us important financial principles, so we can create generational wealth in our personal lives. Understanding IBC is the key to utilizing a dividend paying, whole life insurance policy for creating wealth.

It’s sad to say, but Americans have been convinced to invest in the stock markets in hopes of getting a higher rate of return. Often times this comes at the expense of security. This failure to recognize that IBC is not investing, and we’re not addressing the yield of an investment, often blinds the average person.

As with these businesses, when people discover the truth, they recognize the problem. There is no way to get a higher rate of return by ignoring the banking process.

Practicing The Infinite Banking Concept

Do you know what to do? Imagine the increase in your wealth if you practiced these principles in your own personal life. How much wealth could your family create over a lifetime?

Financing of one of the most basic of major capital expenses would be the use of an automobile. This alone will amount to a substantial sum for anyone. Now imagine if you financed these vehicles over your lifetime utilizing your own private banking system.

You don’t have to stop there, consider financing the costs of appliances, college or a business. You can do all of these things, and protect yourself from risks, using IBC. It’s all outlined in the bestselling book, Becoming Your Own Banker.

And, you can learn more here: https://legacyinsuranceagency.com/infinitebanking

Untile next time,

Barry Page

Barry Page is an Authorized Infinite Banking Practitioner, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps clients with tax-advantaged investment alternatives, and specializes in showing families how to protect their assets, income and lives using a unique financial approach to planning.

#EVA

#IBC

#EconomicValueAdded

#InfiniteBankingConcept

#BecomingYourOwnBanker