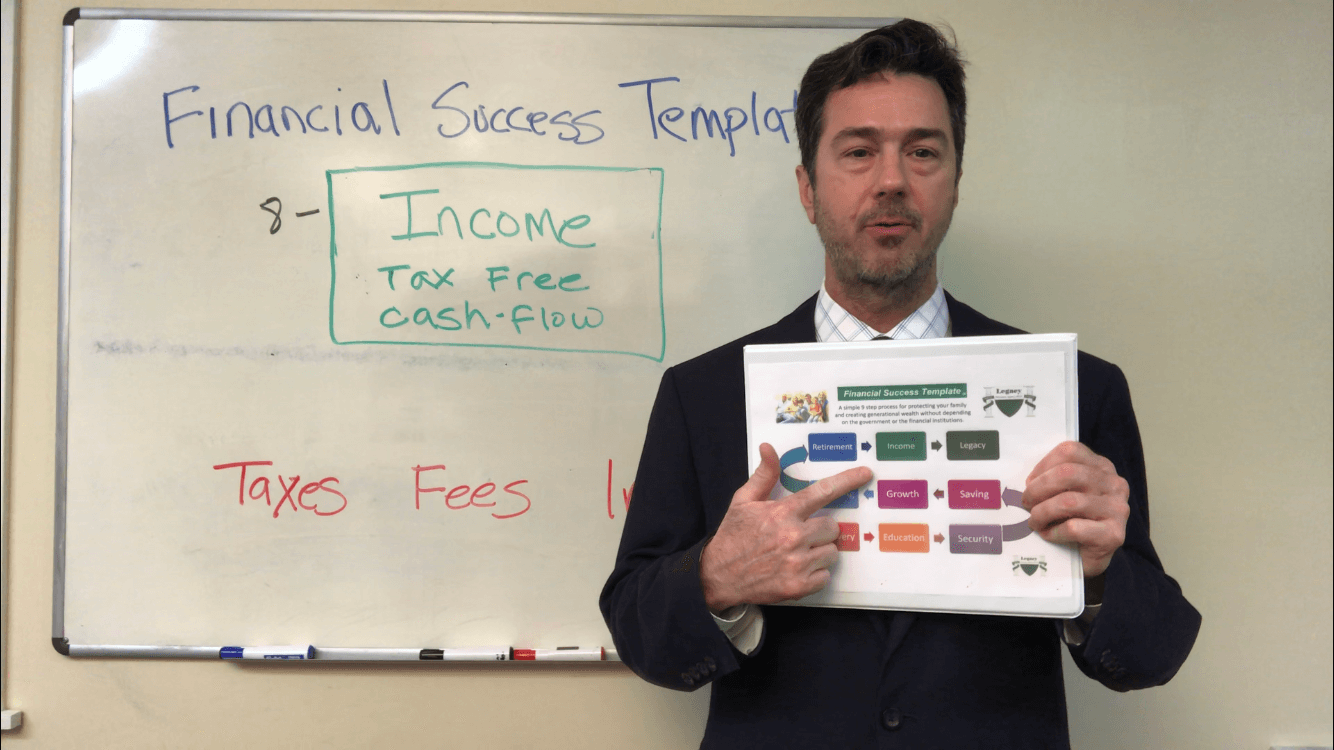

Retirement Income Cheat Sheet

Instantly download our Retirement Income – Cheat Sheet (pdf) from our Financial Success Template. And, I’ll show you the exact process we use with our clients, so you can retire comfortably with less risk and worry.

How to significantly increase your retirement income by legally avoiding wealth transfers to taxes.

Follow this simple retirement planning strategy and you’ll learn how to create tax-free income for life, so you can retire on your terms, without depending on Wall Street or Government plans.

Retirement Income Questions:

- What will your income tax bracket be when you retire?

- What will your tax liability be when you retire?

- What will the impact of taxes be on your income?

- How will Social Security and Medicare be effected by taxes?

- What assets will you have available?

- How will you spend your assets?

- How long will you require income during retirement?

- What happens if you live too long?

- What do you want your legacy to be?

In retirement, you will want to plan for your cash-flow needs and choose assets that have the appropriate level of risk to match your needs. The amount of income you receive and report on your tax return may be much different than your annual cash-flow needs.

The bottom line with retirement income is cash-flow.

Retirement Planning doesn’t have to be complicated. Take the time now to plan and secure your retirement today.

Simple Retirement Planning

Your retirement plan doesn’t have to be complicated, we keep it real simple. We use specialized retirement planning tools and calculators to provide you with the most comprehensive planning available, however, in most cases we can build your retirement plan on a notepad.

Monte Carlo simulations prove that traditional financial planning can fail most of the time. Knowing that, do you want to gamble with your retirement income?

Using these methods, we are told to live off of 4% or less of our nest egg before taxes, for fear running out of money. Would you rather try to live off a measly distribution of 4% taxable income, or would you rather have safety and more predictable tax-free income with less worries?

We can help you can develop a safe strategy for retirement without risking your nest egg. You can also benefit from the tax advantages offered by these time tested strategies that have been around much longer than the income tax. These tax benefits are not offered with financial products like cd’s or stocks, and allow more flexibility than traditional retirement accounts.

Do it yourself planning or turning your money over to someone else can cost you dearly. We will work with you to help you maximize your tax free income during retirement, while minimizing your risk, tax liability and wealth transfers.

In the long-run, our clients are able to significantly increase their protection, decrease their risks and substantially increase their spendable income at retirement.

Just Complete Your Information and Instantly download our Retirement Income – Cheat Sheet (pdf)

Retirement Planning Consultation

Get started today, follow this link to schedule your financial consultation.

Where? In person or at your home or office. You can attend a meeting using your computer (saves time and travel expenses).

When? At your convenience, weekdays during normal business hours.

How Much? Our initial consultations and reviews are complimentary and completely free of charge.

We do not provide tax or legal advice, and accept no liability for the information we provide. We are not responsible for information from outside sources and the links we provide to other sources.

The terms tax planning, and retirement planning, are used in a generic form here because of their relative significance to financial success through planning. We provide educational information to our clients, and those who visit our website, in search of financial information and specialized knowledge.

Our goal is to provide maximum protection for our clients through proper insurance, while helping them attain their financial goals, with efficient resource management and macro planning.