Infinite Banking Think Tank 2022

Birmingham, AL

What a blessing to spend a couple days at the Infinite Banking Think Tank with friends who love the Lord and love helping people. ![]()

![]()

![]()

This year’s IBC Think Tank was held at the beautiful Florentine Building in downtown Birmingham, AL. This was the perfect setting for the event with an elegant atmosphere, helpful service, and delicious cuisine.

Every year IBC Practitioners from all accross the USA and Canada come to learn and grow with each other. This year’s Think Tank theme was The “Nelson Nash Standard”.

Imagination and Learning

Nelson Nash was an advocate for continuous learning. Not only was he the bestselling author of Becoming Your Own Banker ©, but he loved to read and he encouraged others to do so as well.

Learning is the beginning of wealth. Learning is the beginning of health. Learning is the beginning of spirituality. Searching and learning is where the miracle process all begins.

~Jim Rohn

Nelson described * Becoming Your Own Banker (BYOB) as a textbook, and his seminar as a ten-hour course of instruction about the power of dividend-paying whole life insurance.

This book is not about investments of any kind. It is about how one finances the things of life, which can certainly include investments. It is not about rates of return. As time goes by interest rates are up and interest rates are down — but the process of banking goes on no matter what is happening.

~Nelson Nash

David Stearns, Nelson’s son-in-law, produced the entire event with fellow Directors of the Nelson Nash Institute, Carlos Lara and Robert Murphy.

Although primarily life insurance agents attend the annual event, this year provided further insight as to why BYOB is not a sales tool for life insurance agents. Alternatively, it is education that the life insurance industry should have been teaching to agents and the public.

IBC Think Tank Topics for 2022 included:

- The “Nelson Nash Standard.”

- How does the 7702 rule effect IBC?

- What about the 90/10 policy design?

- How will the current state of the economy impact IBC?

Guests and Speakers

Regardless of your thoughts on politics and the state of our economy, we can probably all agree that times could get tough in the near future. Our ability to control our personal economies, specfically the banking function in our lives, will determine our ability to deal with whatever happens.

Rethink Your Thinking

Thinking was one of Nelson’s favorite past times and he always asked us to just think. Solutions to our problems are often right in front of us.

And, while we may complain about our situations in life, thinking can change our outlook. Positive thinking reduces stress and can provide menaingful enjoyment.

We should all have an attitude of enjoyment. God has blessed us with talents and abilities, we must use these precious resources.

“Learn to enjoy every minute of your life. Be happy now. Don’t wait for something outside of yourself to make you happy in the future. Think how really precious is the time you have to spend, whether it’s at work or with your family. Every minute should be enjoyed and savored.”

~Earl Nightingale

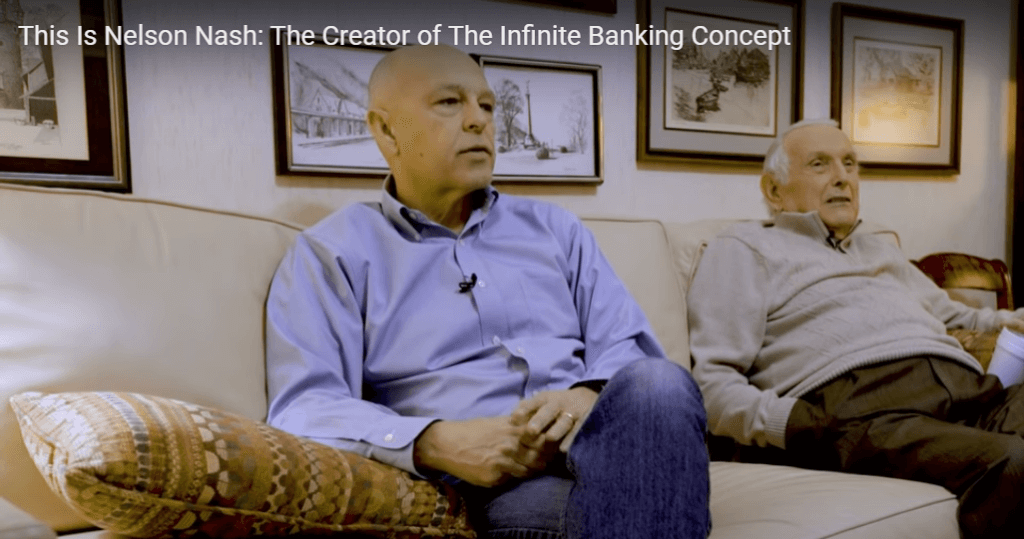

R. Nelson Nash, author of the bestselling book, Becoming Your Own Banker

In the book, Becoming Your Own Banker, Nash explained that Americans devote a shocking percentage of their monthly income to finance charges of various kinds like credit cards, car payments, mortgage. Yet they like to brag about the rate of return they think they are earning on their small amount of stock market investments.

Americans typically focus on the rate of interest, and ignore the volume of interest they pay out each month. This is surprising to some, realizing it’s a much larger percentage of their monthly income.

Nash often discussed the various psychological pitfalls that plague Americans and impede disciplined saving.

- Parkinson’s Law,

- The Arrival Syndrome

- Willie Sutton’s Law

- The Golden Rule

- Use It or Lose It

Let me make it abundantly clear—I am not talking about a bank in the conventional sense of the word. I am demonstrating that one can use dividend-paying whole life insurance to solve one’s need for finance throughout one’s life.

~Nelson Nash

The Nelson Nash Institute

The Nelson Nash Institute (NNI), was formed to provide education on the theory and application of life insurance, to both the general public and the financial services professional.

Our mission is to educate and inspire individuals to take control of their financial lives by reclaiming the banking function from outsiders.

In all, the Infinite Banking Think Tank is a place where IBC Practitioners can come and share ideas with other like minded individuals. Each year provides new insight into the world of finance and what we can do as Americans to protect our families and help control our financial futures.

Barry Page, RFC is recognized as a leading expert on finance, life insurance and privatized banking. He is an Authorized IBC Practitioner and independent insurance agent. He specializes in showing families how to utilize The Infinite Banking Concept.

His specialized knowledge and services help consumers find alternatives to traditional investing and the stock market. His business is based in Ocean Springs, Mississippi and he services clients throughout the Southeast.

*The term The Infinite Banking Concept (Infinite Banking Concepts) is Registered and Trademarked.

*The term Becoming Your Own Banker is Registered and Trademarked.