MegaMillions $Billion Jackpot!

What’s the Best Option Cash or Annuity?

The largest MegaMillions jackpot in history… $1.537 Billion has apparently been won by a South Carolina ticket holder.

Laws vary from state to state, though in South Carolina, lottery winners can remain anonymous if they choose. The winner will now be pressed to make the decision between taking a cash payout or choosing an annuity.

So, what does this have to do with you and personal finance? Ironically, these choices are basically the same ones we have to make with our retirement income. Do we gamble and take chances or do we play it safe? And, when we actually retire, what’s the most efficient way to get paid?

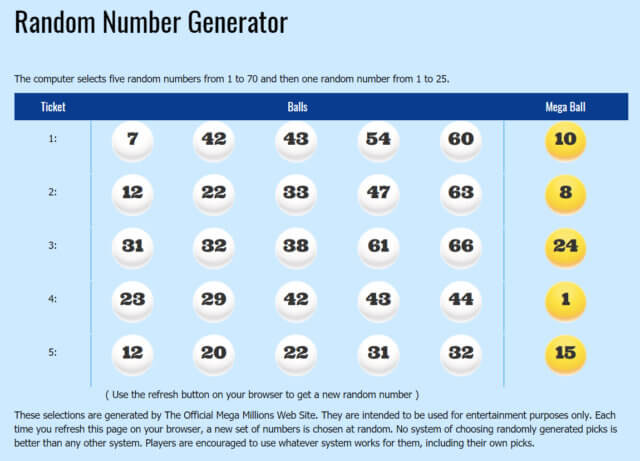

Here’s the drawing and the LUCKY Numbers…

5 – 28 – 62 – 65 – 70 – 5

Lottery Jackpots and Numbers

While estimates vary, the chances of winning the Jackpot are roughly 1 in 300 MILLION. According to a recent survey, about half of Americans play the lottery, compared to nearly 70% during the 80’s.

That means the lottery needs to extract more money from fewer people, which typically means the households that can least afford to gamble. This particular segment, or the lowest-income households, spend on average $412 per year on lottery tickets. That’s more than four times the amount spent by the highest-income households.

Increasing Your Chances of Winning

Faced with a dilemma, Mega Millions decided to decrease each person’s chance of winning while hoping to still draw more people into the lottery, by growing the size of the jackpots. When people see the jackpot growing to these large amounts, they are more willing to buy a ticket.

Currently, each player picks 5 numbers between 1 and 70 and then one number between 1 and 25. Before 2017, players picked 5 numbers between 1 and 75 and then one number between 1 and 15.

If someone is fortunate enough to win a Mega Millions jackpot, they can choose how to be paid, either the cash option or by annual payout. And while prize claim parameters vary from state to state, the MegaMillions Jackpot offers these payout options.

From the MegaMillions Lottery website, Details on Cash Option or Annuity Option:

Annuity option: The Mega Millions annuity is paid out as one immediate payment followed by 29 annual payments. Each payment is 5% bigger than the previous one. This helps protect winners’ lifestyle and purchasing power in periods of inflation.

For a typical jackpot of $100 million, the initial payment would be about $1.5 million, and future annual payments would grow to about $6.2 million.

When the jackpot is $200 million, each payment is twice as big. When the jackpot is $50 million, each payment is half as big, etc.

Cash option: A one-time, lump-sum payment that is equal to the cash in the Mega Millions jackpot prize pool.

Either way, $1.5 Billion should go a long way. And considering Mega Millions tickets cost $2.00 per play, that’s not a bad return!!!

Can You Retire on a Million Dollars?

So, what’s the best option? Well it depends… It depends on your personal financial circumstances.

Just like retirement, where we accumulate a cash pile in our nest egg over time, we then have to choose how to distribute the money over lifetime. While most people will probably never truly understand how an annuity works, the simplest explanation is that it is a guaranteed payout over a period of time. And, a cash option could be looked at as a lump sum distribution.

The questions to ask yourself are, do you want to take all the money now? Or do you want to take a limited amount as income over time. Of course there are lots of other variables to consider, like control, risk and taxes.

Options for Retiring Without Gambling

If you’re tired of gambling with your money, hoping you’ll hit the jackpot, there are more sensible solutions. You’ll still have to make some of the same decisions about how you take income, but those are faint in comparison to the payout you can receive and spend.

Learn more about your options by following this link and requesting a complimentary personal financial review.

Until next time,

Barry Page, RFC

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps clients with tax-advantaged investment alternatives, and specializes in showing families how to protect their assets, income and lives using a unique financial approach to planning.

Subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Find us on Facebook: https://www.facebook.com/legacyinsuranceagency