Retirement Income

Planning for your retirement income distribution can be tricky. Ultimately, most people want predictable income or cash-flow to cover their expenses during retirement, and hopefully have some extra spending money.

The Problem with Tradtional Financial Planning

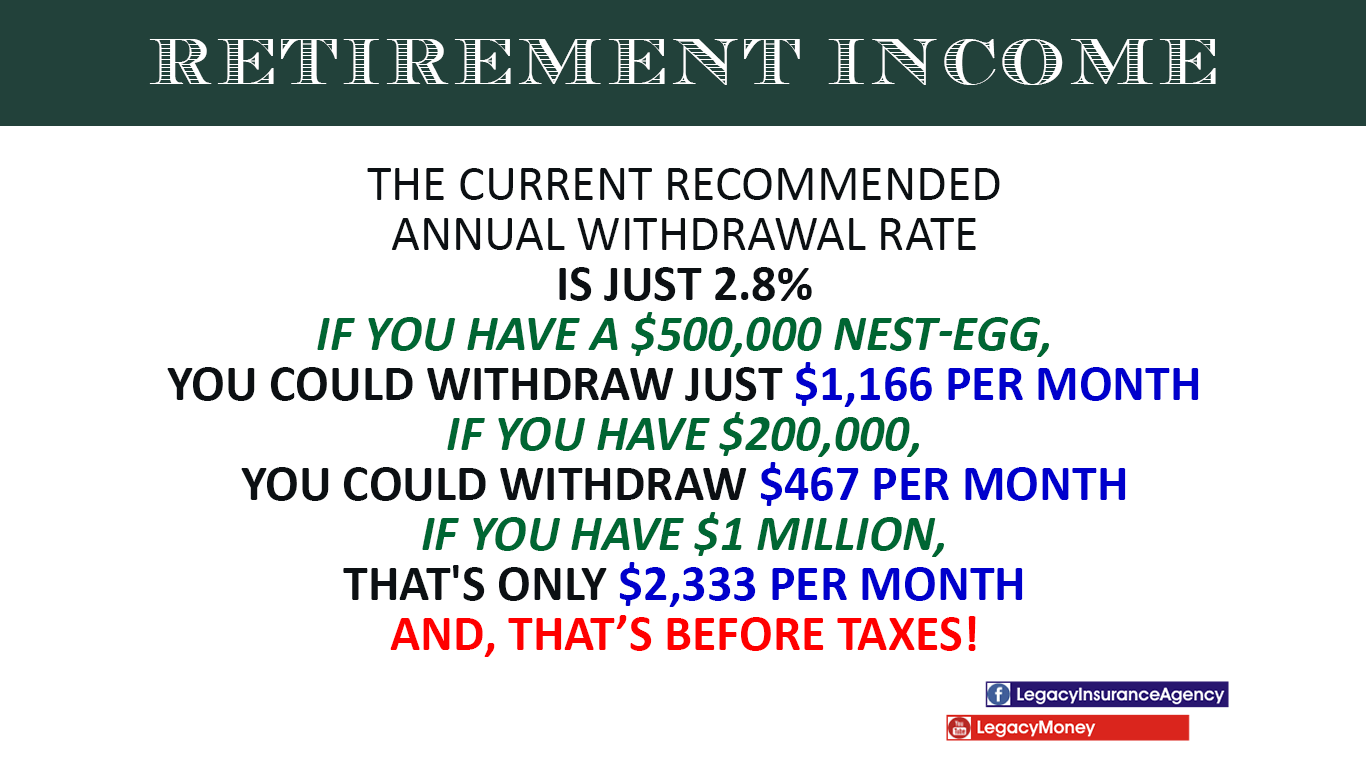

While traditional financial planning suggests witdrawing funds using a hypothetical annual withdrawal rate, this is usually not enough for the typical family.

Furthermore, these plans make recommendations to rebalance your portfolio based on your risk profile during retirement. Unfortunately, this only reduces the amount of cash that we actually have to spend.

Ironically, none of the most often recommended retirement plans (ie IRA, 401k, 403b, SEP) account for future taxes. The reason is, no one knows what income taxes will be in the future.

Even though a ROTH account offers tax free retirement income, there are limitations and risks. The IRS determines contribution amounts and they may not be available for high income earners. They are also limited by contribution limits, and come with some ever changing rules.

Uncertainty and Retirement

The major risks of retiring include market risks, tax risks, health and longevity risks. All of these are uncertain.

This uncertainty with IRS Qualified Plans (IRA, SEP IRA, SIMPLE IRA, 401(k), 403(b), 457, etc) has left retirees wondering if they will have enough money to last through mortality. Complicated formulas dictated by the IRS require constant management and accounting.

And, it could be worse for younger people, with inflation starting to have an impact. A healthy 45-year-old couple is projected to spend an inflation-adjusted $1.4 Million just on healthcare during their lifetime.

How Much Will You Have to Retire?

According to a Federal Reserve Survey of Consumer Finances, the typical household nearing retirement has an average of only $135,000 in their combined retirement accounts. Sadly, this will not support most people’s idea of retirement.

What’s worse is, IF you have followed traditional financial planning, how do you distribute that money as Retirement Income? What amount can you withdraw and spend after taxes?

Required Minimum Distributions (RMD)

Another problem with qualified retirement plans is the required minimum distribution or RMD.

From the IRS website: Required minimum distributions (RMDs) are the minimum amounts you must withdraw from your retirement accounts each year. You generally must start taking withdrawals from your traditional IRA, SEP IRA, SIMPLE IRA, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after Dec. 31, 2022).

So, the IRS sets these rules, and you have no control. You may be penalized with a 50% excise tax if you do not follow the rules by not taking the RMD’s. They tell you how much you can contribute to the plan, and when you can distribute the income.

Wealth Transfers

Then we have wealth transfers… While we’re working, when we retire, and when we pass away. Taxes will be the largest transfer of our wealth.

There are many taxes that we pay, but the income tax is the greatest. Consider that with tradtional plans, you’ve only postponed paying income taxes until you retire. Having to pay more taxes when we retire isn’t a good strategy.

The risks associated with retirement increase as we near that point in our lives. Uncertain withdrawal rates and uncertain tax rates at distribution only compound these risks.

Good News About Retirement

The good news is, there IS A Better Way! One asset class allows you to grow your nest egg, and distribute income, completely income tax free. And, you can offset the taxes you’d normally have to pay on Social Security income.

Financial planning doesn’t have to be complicated. Our proven financial strategies show you how to have your dollars work harder while you take less risk.

How To Retire with More Spendable Income

Our approach to planning is different. Our goal is for our clients to have maximum protection and maximum cash flow, now and at retirement. In some cases, a completely income tax-free retirement is possible.

Schedule your no cost discovery meeting and learn what you can do to increase your spendable income at retirement… Before it’s too late.