Retirement Income Options

Protect and Maximize Your Cash-Flow

Retirement income options are available to anyone who chooses to seek knowledge and plan ahead. Your options for how you distribute your retirement income are mostly up to you. It all starts with where you choose to store your money. We can’t control government rules such as taxes, but we can control how we save for the future, which will have a tremendous impact when distribute the income.

Assuming that you have accumulated a nest egg for retirement, you will then have choices for the distribution of that income. Traditional retirement planning suggests that you defer taxes for the future. This option may not always be in your best interest.

Do you know what your tax rate will be 30 years from now?

A whopping 89% of the people we’ve surveyed believe tax rates will go up in the future, due to our country’s unsustainable debt and aging demographics. Unfortunately, if tax rates do go up and you’re successful in growing your nest-egg, you’ll be paying more taxes on a larger balance.

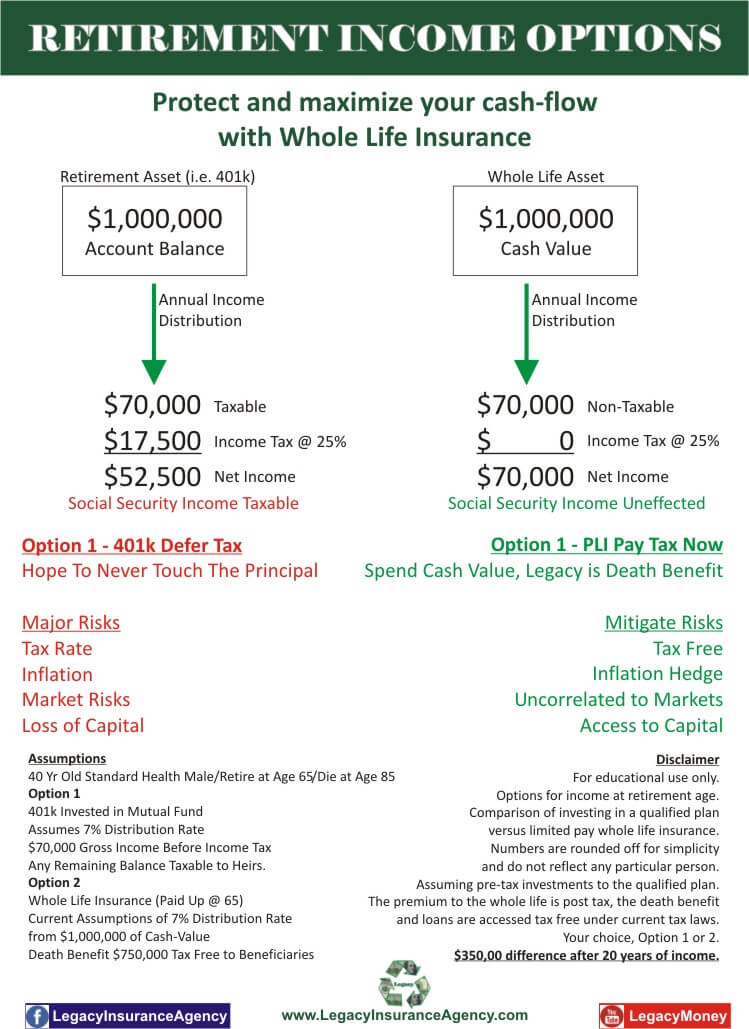

In the example below, we’ve assumed that you’ve accumulated $1,000,000 in your nest egg. Regardless of how you got there, in this example it’s either stored in a government qualified plan such as an IRA or 401(k), or in cash-value, whole life insurance.

We are not suggesting that you could withdraw 7% out of your retirement plan that is invested in the stock market without the fear of running out of money, but we have to compare to something. And in most cases you can take a 7% withdrawal from a properly structured, dividend paying, whole life policy.

Retirement Income Options – IRA compared to Whole Life

As you can see, $70,000 of tax free income is much better than $70,000 of taxable income. But, that’s only part of the beauty of this retirement income option.

Other Benefits of Whole Life Insurance

- Mitigate the risks of longevity

- Uncorelated to markets

- Tax-Free withdrawals

- Access to capital

- Inflation hedge

Where you store your money is more important than what it earns. You can plan for your retirement income and maximize your cash flow, contact us to learn how: http://legacyinsuranceagency.com/retirement-planning