Retirement Planning with Life Insurance

by Barry Page, RFC and IBC Practitioner

You can do your own retirement planning with life insurance. Life insurance is the cornerstone of any financial plan, and the only financial product that can stand completely on its’ own. And, by practicing the Infinite Banking Concept ™, you can create cash flow now, and passive income later.

Before going any further, we need to understand, why you may need a retirement plan. Where did this word, retirement, come from in the first place?

Retirement, or the practice of leaving one’s job and ceasing to work at a certain age, was created in the 1800’s by Otto Von Bismarck in Germany. Later other countries followed suit and it soon became government policy. Because they promise to make life easier, these programs have been popular. Look at how far we’ve come today, with new laws and more government programs being created every year. These programs are really just another way for the government to create dependency and collect revenue, it’s really a shame.

The plans we advocate utilize our own resources and capital to protect our assets and save for the future. Therefore, we don’t have to depend on government plans to retire, or banks for lending. This requires some self discipline and management, but most agree this is a better way.

Passive Income Time

My mentor, Nelson Nash, didn’t like the word retirement. As a matter of fact, he liked to call it passive income time. While some people, usually business owners, understand passive income, I find that those with careers and normal jobs usually don’t. Working at a job produces earned income, we trade our time for dollars. On the other hand, passive income comes from an asset, and usually income tax free.

“Profits are better than wages.” ~Jim Rohn

Problems with Other Retirement Plans

Traditional financial plans typically revolve around mutual funds inside of government qualified plans (401k, IRA, SEP, ROTH, etc). These types of plans are a product of the Internal Revenue Service (IRS) and are dictated as such by the IRS tax code. Usually they are administered by a financial institution, such as a wealth manager or broker/dealer.

Although these plans have their uses, there are problems with these plans, primarily because of risk and uncertainty. Compounding these problems is the fact that many people were lured into these plans with a false sense of security. They were led to believe that the stock market only goes up, that interest rates will remain low, and they’ll be in a lower tax bracket when they retire.

The fact is, all of these things are uncertain. Obviously, we can not control the stock market, and all you have to do is look at history to know that. We don’t know where the markets will be when we retire, or perhaps are even forced to retire because of injury or illness. And, with government spending out of control, who knows what tax bracket they’ll be in when they retire 20-30 years down the road?

How To Fund Whole Life Insurance to Become Your Own Banker

For a further explanation of creating passive income, you may want to watch this video. And, please subscribe to our channel, and like it if you get value.

Banking Now and Income Later

How to become your own banker and create tax-free passive income using whole life insurance.

Nelson Nash, the creator of the Infinite Banking Concept ™ (IBC), chose whole life insurance (he didn’t like that name either) as the preferred financial tool because it’s a safe place to store our capital and warehouse our wealth for future generations. These specially designed policies inherently have a banking function built into them.

This function, or the banking process, is controlled by the policyowner and provided by the life insurance company. Meaning the policy or contract can be used for financing, and the owner sets most of the terms. The company determines a competitive interest rate, and collects the interest due annually. The policy serves as the collateral, and the policyowner owns the contract. So if a loan is outstanding, the insurance company knows the loan will get paid, either with a reduction of the death benefit or cash value.

Solving the Financing Problem

If we solve for the need for finance, instead of guessing what our family will need when we die, life insurance benefits are multiplied. We know that it takes money to live, and most people use credit or finance to make major capital purchases, so solving for finance when purchasing life insurance can eliminate the problem of debt.

And, if we have access to capital, we don’t have to depend on banks or financial institutions for lending. To turbo charge IBC, we can buy other cash flowing assets like real estate or businesses. The possibilities are really infinite.

Why Life Insurance?

You can use a number of assets to create income for retirement. We happen to like dividend paying, whole life insurance from a mutual insurance company.

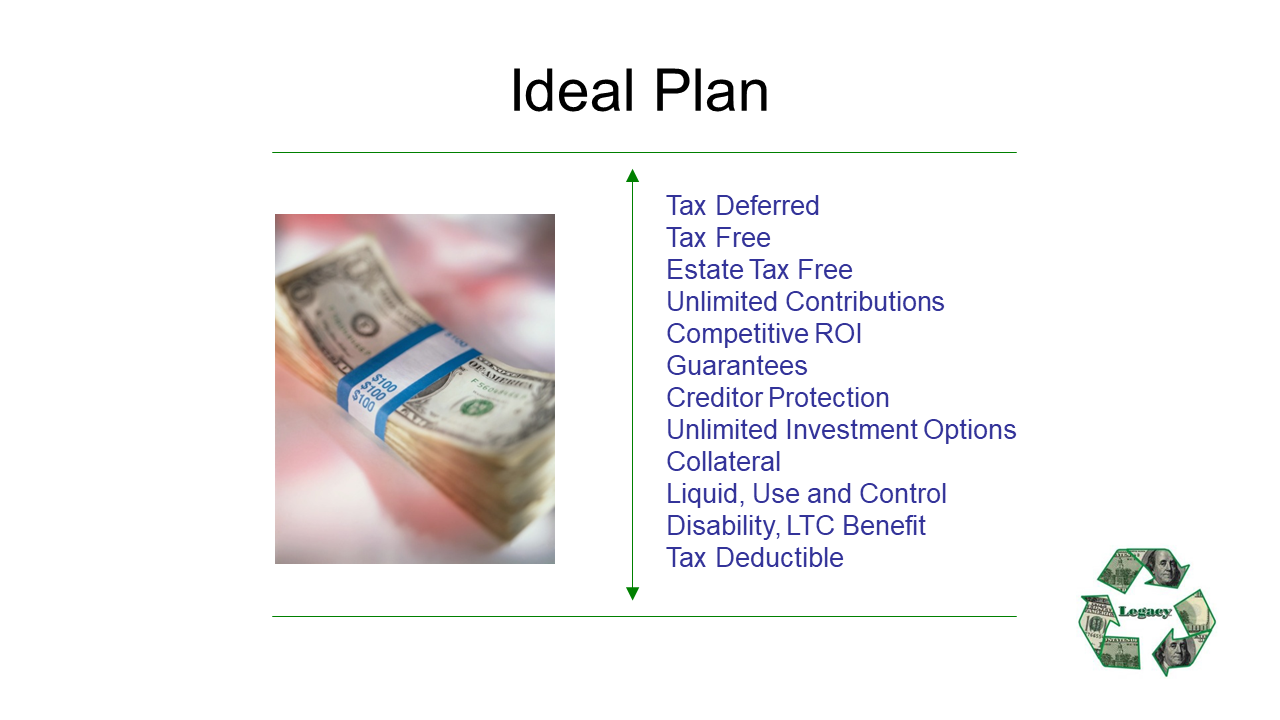

Whole life insurance is a stable asset that reduces risk. It provides provides a facility for savings, and offers multiple uses for the policyowner. The uses of cash value life insurance are many, and these policies provide benefits not available in other financial products.

These private contracts can provide tax-free cash flow once fully capitalized. And can be used for income during retirement or to supplement other plans such as an IRA or the like.

The Ideal Financial Plan

Saving for the Future

We’ve been trained to depend on traditional banks, and become accustomed to direct depositing our paychecks. We often pay our expenses online or through checks issued by the bank.

I recommend creating a seperate account to pay yourslef first. We like to call this account a wealth accumulation account (WAC), but just look at it as a sweep account or resovoir to build your savings.

Once you’ve determined how much you want to save, do this every pay period until you’ve capitalized an account with at least 6 months of income. The important thing is to pay yourself first and develop the habit of doing this without pause.

Your household expenses will still get paid from your regular checking account. Over time, you’ll find that you are more aware of the true costs and losses.

After you’ve saved enough in this account, you can start to fund a cash value life insurance policy. This can be a percentage or a number that you choose with your agent. We recommend striving to save 20% or more of your income for retirement (passive income time), but you can determine how much you want to go into your system.

This private contract will have a policyowner, likely you. But you may eventually want to own multiple policies with other family members insured. You can pay the premiums paid from this WAC, and utilize the carrers online services to make loans and repay loans.

An Alternative – Retirement Planning with Life Insurance

A Life Insurance Retirement Plan (LIRP), is a simple financial plan, designed to optimize wealth and income, with less risk than traditional financial plans.

LIRP’s provide an alternative to traditional planning, and can act as a buffer to supplement income during down market years.

These private plans can provide complete control of your finances and help create generational wealth for your family. If you want truly passive income you can use your policy to distribute income at to that point in life.

Distributing Income or Cash Flow

Many assets can distribute income, but you will likely be paying taxes. Even worse, you could run out of money if you have losses.

The great thing about life insurance is, you can receive cash-flow completely tax-free. You just have to follow a few guidelines.

If taking surrenders or distributions, once you have reached your cost basis, you may want to switch to loans. If the policy is contractually paid-up, you could even take dividends at that point in life.

At Retirement, You’ll Want Options

So there are lots of options and ways to go about it, that’s the point, you have options. You can even distribute all of the cash value in the policy back to you. It’s up to you if you want to leave a death benefit to a beneficiary.

If you have treated your policy as an honest banker, you can typically receive back more than you have contributed. And, still leave an inheritance to your heirs.

Ultimately, you can leave a legacy for your family and heirs, so they can have financial freedom as well. It’s your plan, so it’s really up to you.

Learn More

Get free access to our Retirement Income MasterClass

Meet with an Infinite Banking Concepts™ Professional (IBC Authorized Practitioner)