Retirement Risk – How To Avoid Running Out of Money During Retirement

Retirement risk threaten retirement and can reduce income. Learn how to avoid running out of money during retirement and find opportunity by staying liquid and avoiding losses.

To avoid running out of money during retirement, there’s a much simpler way than by trying to balance market risks and the probability of returns.

Market Risk

Market risk is a huge threat to retirement income, but there are solutions that provide safety and access to opportunities.

Pertaining to investing in the stock markets, there’s one primary risk for retirees. This could make the difference between enjoying a comfortable retirement and having to struggle, foregoing life’s luxuries. And maybe even life’s necessities.

But very few are talking about this risk. And, there’s a good chance you haven’t heard about it from your advisor(s) either.

This fluctuating risk could be more devastating to your retirement security than living longer than you expected; Or being forced to retire sooner than you planned. (which happens to nearly 50% of Americans, according to the Employee Benefit Research Institute)

Sequence Of Returns Risk

Pre-retirees and retirees who have a major portion of their assets in stocks and mutual funds, face the very real risk that the markets will drop as they are preparing to, or when they are withdrawing money, from those accounts.

“Retirement is a difficult time for many people”, what happens during this “fragile decade” could have a debilitating impact. This is according to Dr Wade Pfau of the American College of Financial Services.

A market crash while approaching retirement, or in the first 5 years after, can deplete your wealth and income rapidly.

If you suffer a significant loss of assets during this 10 year (fragile decade), it’s almost impossible to recoup the losses.

If this happens you’ll have a lesser amount to benefit from during any market recovery, over a shorter period of time.

This could mean having to cut back on your retirement lifestyle, or be forced to work longer than planned, or both.

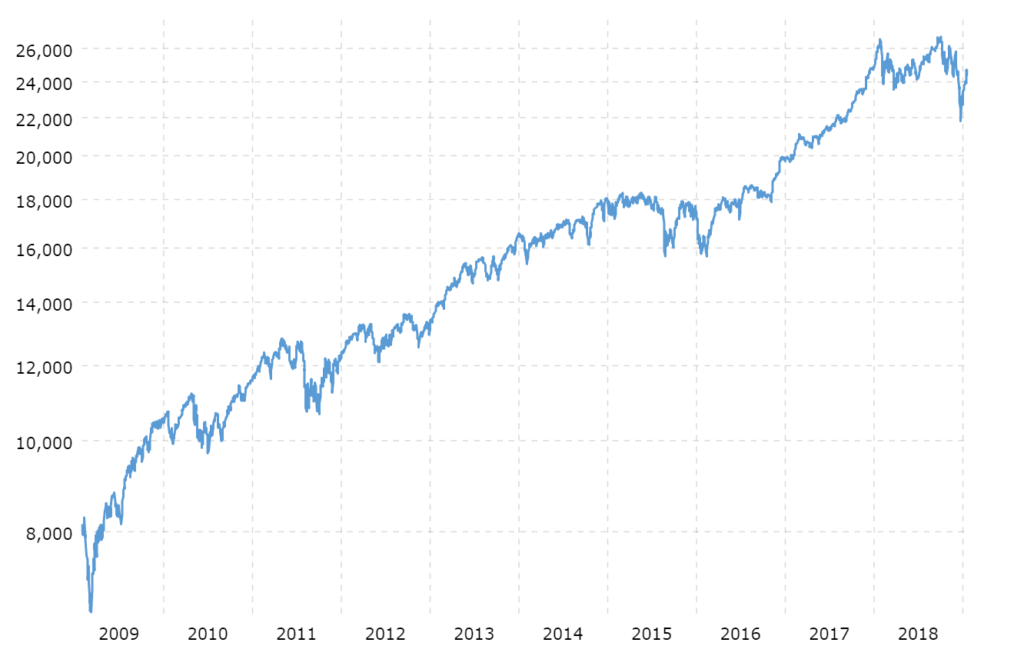

Looking at market history, the likelihood of a major stock market crash is greater today than any other time in the last decade. We are still in the longest running bull market in history, nearing its 10th anniversary.

Of course, it’s possible that it could last beyond then. But is it worth risking your retirement security on this happening?

Retirement Risks

The Center for Retirement Research reported that fully 60% of households are at risk of facing a retirement income shortfall. This number would only be compounded in the event of a market decline.

Advisors are recommending retirees have 10-20 times their annual household income saved. Unfortunately most are no where near that number.

Another report from the Economic Policy Institute (EPI) also found that many Americans are highly unprepared for retirement.

Many experts today say you should only plan on withdrawing a maximum of 2.8% of your retirement savings each year, for fear of running out of money.

And, using the old recommended withdrawal rate of 4%, you have a 50% probability of running out of money over a 30 year period.(Morningstar Research Paper by Blanchett, Finke, and Pfau)

Would you board a plane knowing you only had a 50% chance of arriving at your destination safely?

And according to the research firm DALBAR, Inc.; The average investor in asset allocation mutual funds earned only 1.85% per year over the last three decades.

How To Avoid Running Out of Money

So, how can you minimize the losses and maximize opportunities for gain? Follow these safe and simple strategies to have your savings do more, without depending on banks and government plans.

CYA – Cover Your Assets

One way to protect yourself from this very real economic threat is to have your retirement income insulated from loss. Depending on health and other factors, this could be a viable solution to market risks.

Using the covered asset approach, one can transfer a portion or all of their portfolio to another asset at retirement. In this case, to an annuity or life insurance that’s worth the equivalent dollar amount of the other asset.

Insurance companies provide these dependable, financial products. They protect from market risk, longevity risk and can provide guaranteed income for life. These tried and true financial vehicles are available to most anyone, but unfortunately the marketplace can be confusing.

Ironically many traditional pension plans use these same financial tools. But the problem is, in that situation, they are controlled by someone else. Therefore relinquishing one’s ability to utilize them for their maximum benefit.

How the strategy works… By having a separate pool of capital, that is compounding and not correlated to the respective market of the other asset.

When withdrawing money from a 401(k) or other account with market volatility, the concern is taking too much. One could make withdrawals from the CYA account during the years of market declines. This allows the original asset time to rebound and not compound the losses.

This retirement strategy can help provide a positive sequence of returns, even in down markets. This can translate into financial peace of mind for the rest of your life.

Maximizing Retirement Income

Utilizing this retirement strategy, moving retirement savings to a safe asset that has guarantees, can provide multiple benefits and tax-free income.

This safe and versatile asset is participating, whole life insurance. These specific contracts are only available from mutual life insurance companies. Most mutual companies have paid dividends to their policyowners, consistently for a century or more.

Owning dividend paying life insurance from a mutual company allows your money to work harder. So, you don’t have to worry about the next market crash that could wipe out your entire life’s savings.

This functional strategy can also help you to become your own banker. In other words being the financing source for vehicles, vacations, college education, opportunities, business expenses and even retirement income.

After capitalizing the plan, the policy’s cash-value and dividends can be used for cash-flow, or as supplemental income.

This strategy can also work together with other investments like real estate or even commodities. It can apply to any asset that has risk involved with producing expected cash-flow.

The Reality of Finance

To rid ourselves of market risk, and the anxiety that comes along with worrying about running out of money, we have to be willing to face reality.

- The reality is that the stock markets will continue to be volatile, and the odds are not on our side.

- The reality is that future taxes and inflation are uncertain.

- The reality is that the future of Social Security and Medicare are uncertain.

- The reality is that we are living longer, so our money has to work harder and longer.

How To Find Opportunity – Liquidity

We all have a finite amount of wealth today. But, we all have the opportunity to create more wealth for the future. The important factors are keeping what we have liquid, safe and growing.

Consider the opportunities that come to us over our lifetime, but for whatever reason the timing may not be good. Imagine having a pool of capital that was growing consistently, and could be accessed at any time without penalty.

Traditional planning focuses on return on investment, resulting in increased risk. When real opportunity arises, it’s hard to measure the return on liquidity.

With money available for profitable investment opportunities, you can take advantage of dips in the market. And, auspiciously other opportunities that may produce leverage or even arbitrage can appear when you have liquidity.

Following our strategies provides a resource for capitalizing on opportunities and financing. This could result in more wealth and more cash-flow for your family or business.

Add these tried and true market alternatives to your financial plan and multiply your net results. The possibilities are infinite.

Using the financial strategies we advocate can literally add life to your retirement years. By rethinking retirement and taking control of your finances, you can turn risk into opportunity.

Find out how a custom-built financial strategy could help you reach your retirement dreams, without unnecessary market risk. Schedule a quick discovery meeting so I can learn more about your goals and help you get started.

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps clients with tax-advantaged investment alternatives. And shows families how to protect their assets, income and lives using a unique approach to financial planning.

Please subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Find us and “like us” on Facebook:

https://www.facebook.com/legacyinsuranceagency