401k Exit Strategy – How To Use Your Retirement Effectively

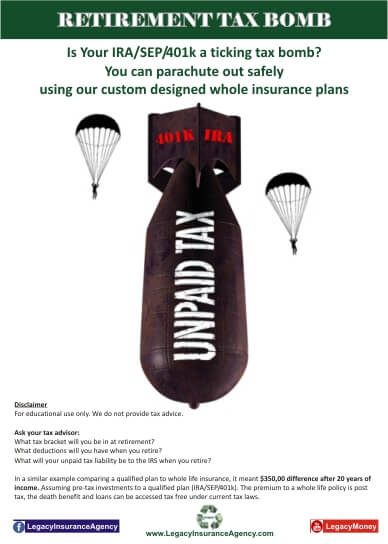

401k Exit StrategyHow To Spend and Use Your Retirement Income Effectively It often astounds me how many people really don’t have an exit strategy for their 401k. And, I mean a money solution, an effective plan to use and spend their retirement efficiently, to reach their desired goals. So, I’d like to share with you a little known, but time tested strategy that is usually reserved for the wealthy. It’s also used by the world’s largest banks and corporations. IRA/401k Distributions (Withdrawals) A 401k withdrawal or distribution is how you take your money from the account, which has rules and restrictions. We’ll assume you areRead More →