Infinite Banking Savings System

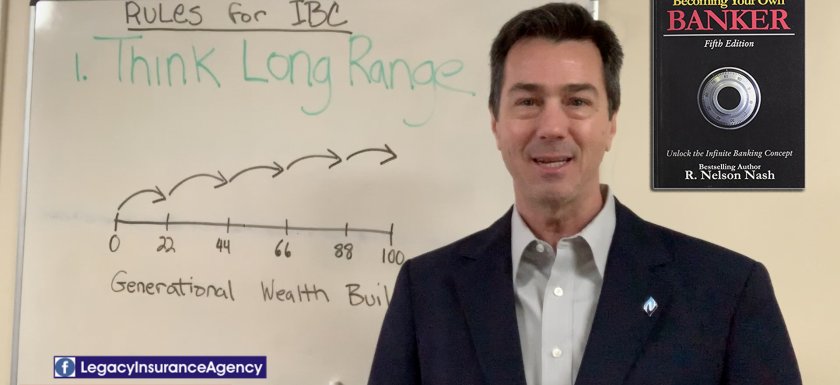

Infinite Banking Savings System How To Save $3,000+/Month with Infinite Banking (Full Breakdown) In this post and video, I’m going to talk about what I call the ultimate financial tool, and a way to systemize your savings, so you can grow your wealth with less risk. It’s not get rich quick. It’s a safe and predictable way to take control of your finances, using the Infinite Banking Concept and good old fashioned, whole life insurance. My mission is simple to help you protect your family and keep more of your money. I’m here to help level the playing field for families and those who seekRead More →