Tax Planning – The Time to Plan is Now

Tax planning is not deferring taxes in an IRA. We’ve all heard the old adage, “People don’t plan to fail, they fail to plan.” In the case of your IRA or qualified plan, last minute contributions could be setting you up to actually pay more taxes.

If you’e pondering the thought of a last minute contribution, just ask yourself these questions…

1. Do you want to live a similar lifestyle in retirement as you have today?

2. Do you think taxes will go up or down in the future?

3. What tax bracket will you be in when you retire?

Most people say they want to live a comparable lifestyle to today in retirement, but they don’t consider things like inflation, healthcare and taxes! Taxes will be the largest transfer of your wealth, and how you plan to pay them will make all the difference.

And, if you think you’ll be in a lower tax bracket at retirement, do you plan on being poor? Did you know that because of IRA distributions, your Social Security benefits could be taxed too?

Of course we can not answer the questions about future taxes and brackets, but just think about it, our government is broke. And, how do they get money?

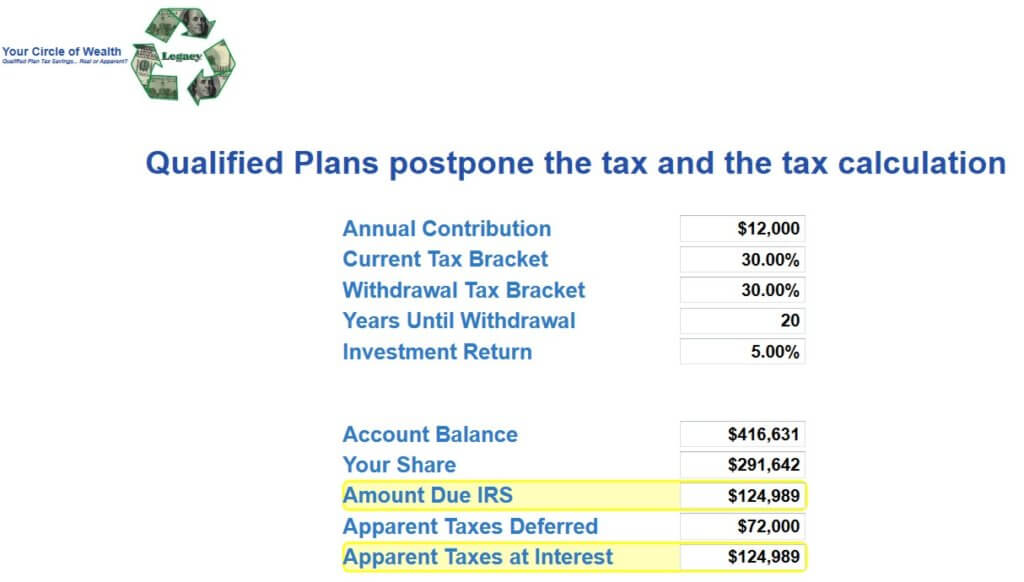

IRA’s and qualified retirement plans (401k/403b/SEP, etc) do 2 things, they defer the tax and they defer the tax calculation. There is no tax savings because of the contribution, you only postpone paying the taxes. And, while your apparent tax savings are growing in your “plan”, so is your tax liability.

Think about that for a moment… If you have an IRA/401k, you have an unknown tax liability to Uncle Sam.

Misinformation about IRA’s and Taxes

We see it all the time, misinformation about IRA’s and taxes. People read articles in magazines, listen to entertainers on the radio and TV, and think they’re saving on paying taxes by contributing to IRA’s and Qualified Plans like 401k’s. Just look at this recent photo I snapped from a major financial publication. They suggest you can save taxes by contributing to an IRA.

There are no savings… You only postpone paying the taxes. And, the argument that you will be in a lower tax bracket is a little “ambitious” You only win by losing?

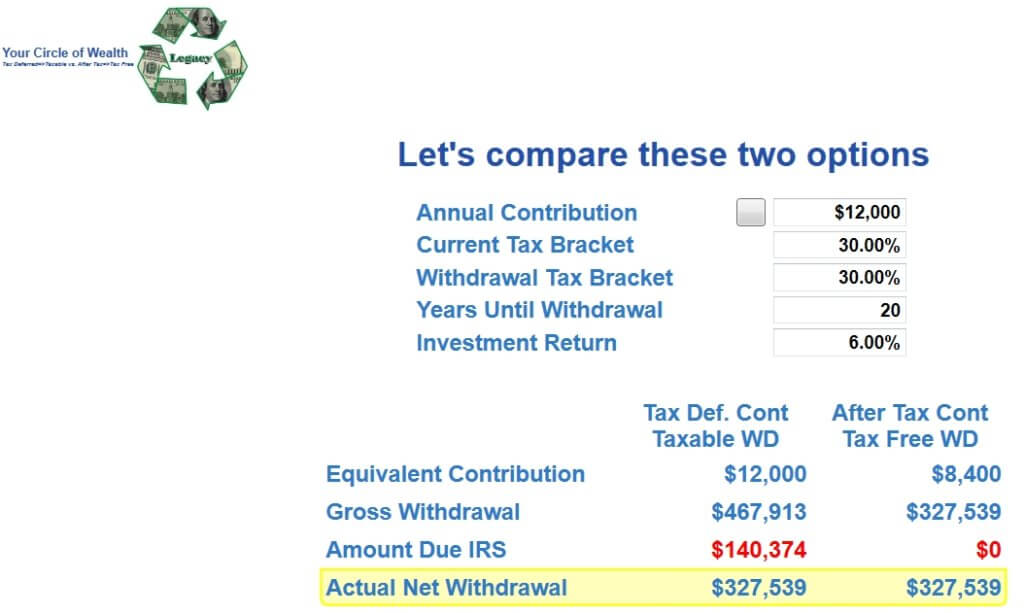

Now let’s look at how much that annual $12,000 contribution grew and how it will be taxed at distribution, when you take the money is when the calculation takes place.

*This example assumes income taxes remain the same and is only hypothetical. You see… Your tax liability grows as your investment grows. You’ve only postponed paying the tax to an uncertain future.

So, before you make that last minute contribution, consider actually planning your retirement with taxes in mind. You probably don’t want to wind up paying unnecessary taxes for the rest of your life.

To learn how you can build wealth and reduce your tax liability for retirement, contact us for a tax planning consultation. Follow this link: Tax Planning Consultation

*Calculations and images from the Circle of Wealth® system.

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps clients with tax-advantaged investment alternatives, and specializes in showing families how to take control of their finances and create financial independence. Barry Page is a financial coach that has been cited on ABC, CBS, NBC and FOX for his work helping families and businesses with wealth building strategies to increase cash-flow, secure capital financing and provide tax-free retirement income.