The Inverted Yield Curve and Possible Recession…

What does an inverted yield curve mean anyway? Is it a sign of a possible recession?

The impacts of government spending and monetary policy have made our country vulnerable to a recession. Unfortunately, the barometer for what is regarded as a recession has changed. And, many of the very people we depend on for a stable dollar, have become corrupted.

Federal Reserve Monetary Policy

Whether or not you’ve ever considered the impact of banking on your finances before, the Federal Reserve’s cartel approach to controlling our money supply has no doubt come across your radar in recent weeks.

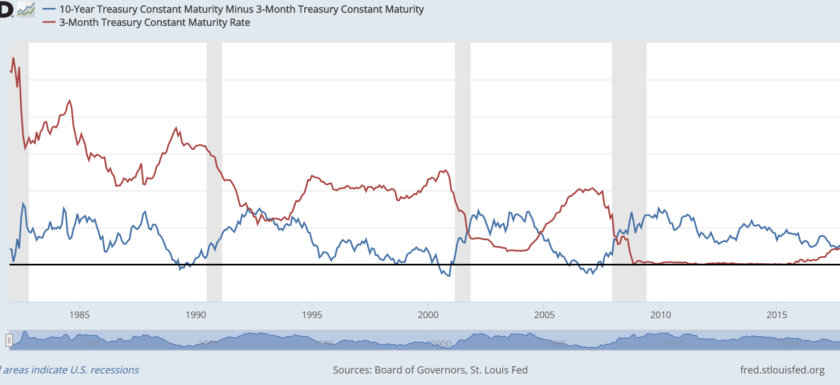

Traditional investors are nervous about an inverted yield curve, as it has historically been the warning sign of a coming recession. This happens when yields on short term bonds are higher than yields on long term bonds.

However, there are differing opinions on what this means. It’s just another reason to become your own banker and create your own curve, without the Fed or government plans…

Austrian Economics

In this podcast, Austrian Economist Bob Murphy, gives a quick explanation of the Mises-Hayek theory of the boom-bust cycle, and how he used it to forecast the financial crisis in 2008 a year ahead of time.

Murphy later explains the significance of an “inverted yield curve,” and shows how the Austrians can understand its predictive power much better than Keynesians, like Paul Krugman can. Listen to the podcast here.

You can read more about the inverted yield curve in the Lara Murphy Report.

Monetary Policy and the Inverted Yield Curve

By now you’ve probably realized that there’s really not a whole lot we can do as taxpaying citizens to control what the Federal Reserve decides to do about interest rates. Which unfortunately effects business, lending, inflation and our investment returns.

But, the good news is, you can make your own financial plans without depending on the Fed. So that, regardless of what interest rates are, you are self-reliant and not taking unnecessary risks with your money.

Infinite Banking

Nelson Nash’s Infinite Banking Concept (IBC) allows individuals to “become their own bankers” through the use of properly designed whole life insurance policies, and sidestep the political process entirely.

Just as you can use FedEx or UPS in order to get around the bureaucratic Post Office, you can implement IBC in order to stop depending on the government and banks.

Creating Your Own Yield Curve

Regardless of your endeavor, you will need capital at some point in the future, either to purchase stuff or for income. What better place to seek access to capital than from your own private bank? Where you determine the availability of funds and the terms…

The best way to learn how infinite banking (IBC) and money work, is to setup your own plan and start financing your own purchases. You’ll find the process is amazingly simple, and you’ll sleep better knowing your family is protected, even in the worst circumstances.

And, by being an honest banker you can participate in predictable returns for your family or business, and future generations.

If you’re still wondering how to make the yield curve work in your favor, schedule a time to talk. We’ll analyze your goals and ideas to see what makes sense for you.

With my warmest regards,

Barry Page

IBC Practitioner and Mentor

Have you liked our page on Facebook? We post fresh content regularly there and I’d love to hear your thoughts and comments.

Be sure to subscribe to our YouTube channel. You’ll find tips and training to help you reach your financial goals.