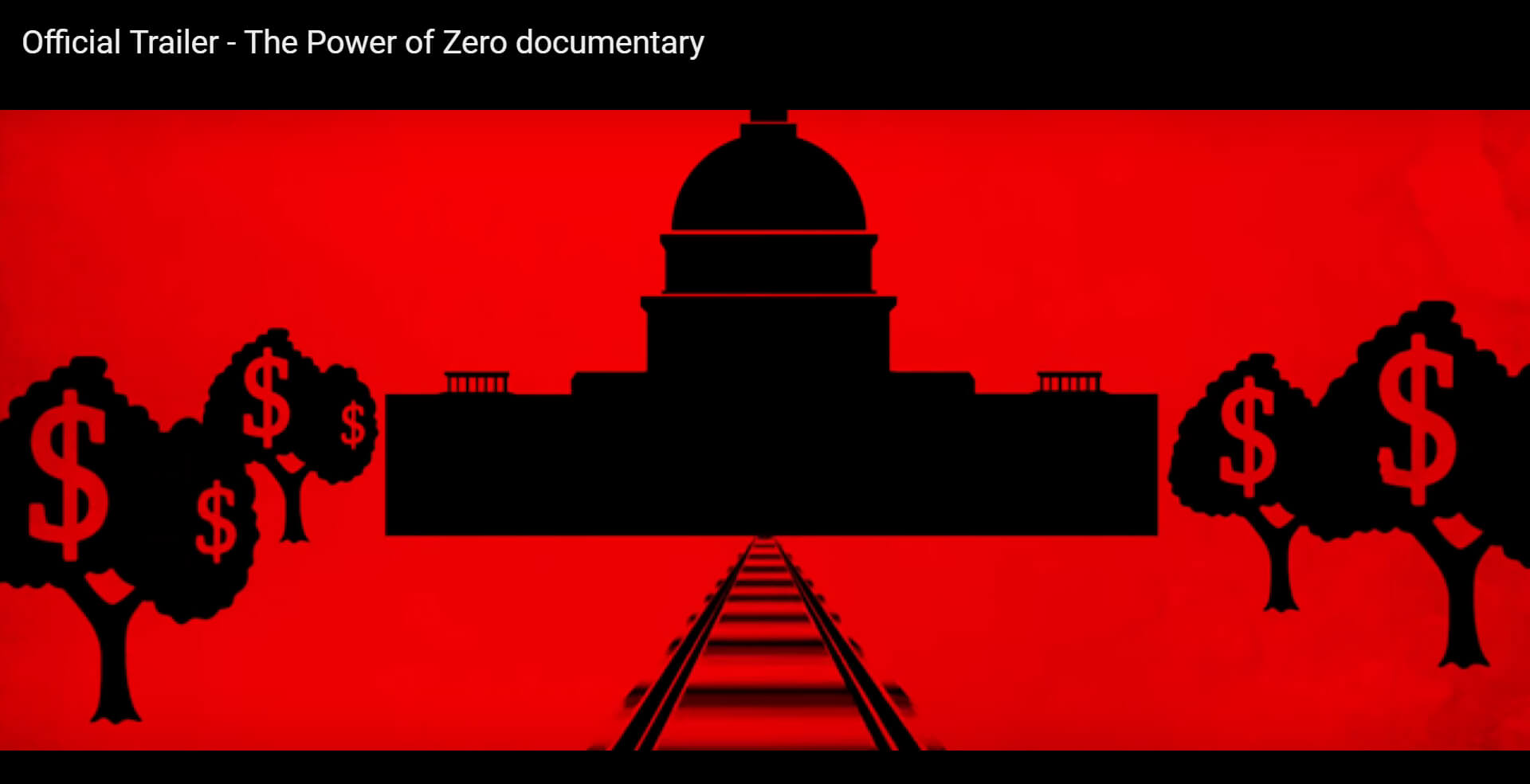

The Power of Zero is a powerful documentary on the state of the economy and the impact of future taxes that is playing in theaters.

As the US debt spirals out of control, it polarizes society and threatens to disrupt traditional retirement options with an impending freight train of onerous taxes and draconian austerity measures.

This trailer is the official promotion used for the film, and approved by the Motion Picture Association of America’s rating program CARA.

The Book

The documentary is based on the book, The Power of Zero, which outlines how to get in the 0% tax bracket and transform your retirement.

This book and documentary are a wake up call to what lies ahead. While we were told to defer taxes in a qualified retirement accounts, the government will soon need huge amounts of cash, and they will have no choice but to raise taxes.

Uncle Sam is driving the train, and he holds the lever to increase taxes whenever he needs the money. The question is, will you be ready?

Fortunately, there is a way to avoid the tax train altogether, and get in the zero percent tax bracket. It’s not for everybody, but most Americans can benefit from this powerful tax strategy.

If tax rates were to double, your retirement could be in serious jeopardy. But, if you’re in the 0% tax bracket and taxes double, then 2x zero is still zero!

Plan for a Secure Retirement

Help yourself plan for a secure retirement. Consider planning your retirement with taxes in mind. You don’t want to wind up paying unnecessary taxes for the rest of your life.

Learn how you can build wealth and reduce your tax liability to zero during retirement, contact us for a tax planning consultation. Follow this link: Tax Planning Consultation

Until next time,

Barry Page, RFC

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps clients with tax-advantaged investment alternatives, and specializes in showing families how to take control of their finances and create financial independence.

Barry Page is a financial coach that has been cited on ABC, CBS, NBC and FOX for his work helping families and businesses with wealth building strategies to increase cash-flow, secure capital financing and provide tax-free retirement income.

Please subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Find us and “like us” on Facebook:

https://www.facebook.com/legacyinsuranceagency