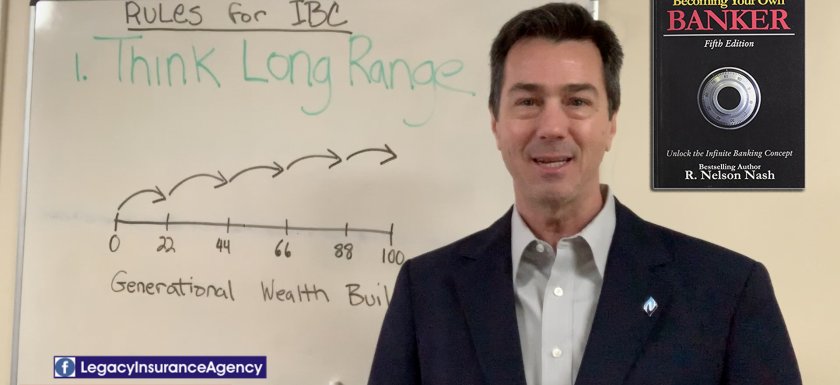

Rule # 1, Think Long Range.

In his bestselling book, Becoming Your Own Banker, Nelson Nash discusses Infinite Banking and the basic rules. But, you had to see or hear him to learn his rules for IBC.

They have changed slightly over the years, but these are

The Rules for IBC.

- Think long range.

- Don’t be afraid to capitalize.

- Don’t steal the peas.

- Don’t do business with banks.

In this video, I’m going to discuss:

Rule # 1, Think Long Range

By far the biggest argument against Infinite Banking is the availability of funds in the early years. This is a result of short-term thinking. In today’s world, it seems that everyone is pitching instant gratification.

IBC isn’t an investment. Therefore you can’t really compare it to stocks, mutual funds, gold, real estate, etc.

IBC is simply a way to take control of your money and the financing aspect in your life.

So, when comparing Infinite Banking to other assets you have to ask, compared to what?

- The 401k/IRA is probably the most popular place that people store their money.

- Real estate is another popular place that people park their money.

- Gold/Silver or Crypto has become popular and liked by my Austrian friends.

Let’s compare those briefly.

What is the advantage of a 401k? Tax deferral (postpone paying). So, people park their money in these government plans for 10-40 years. The money is basically locked up unless you want to pay the taxes and a penalty before age 59 ½ . So, how much of your money is available there in one year?

Let’s look at a $15,000 investment contribution – assume 6% ROI in year 1 and you now have $15,900. Now you want your money back. You could take a loan and abide by the IRS and custodian’s rules. The most you could get would be 50%… But then you pay it back on their schedule or you pay the taxes and penalty. And, you may be subject to double taxation.

If you just withdraw the money via a distribution you will pay the tax and a 10% penalty, and depending on your tax bracket at the time, that could net you maybe $10,000. Not to mention, the fees you paid on the account or the risk that you could lose money.

How about real estate? So, you plop down a down payment on a property. If you live in the property, of course there is no return. Maybe the property appreciates, but that would happen regardless of your down payment. Now, if you want the money (equity) back, you have to apply for a loan. So, the bank is in control, you have to qualify and abide by their rules. And, even if you qualify, the most banks loan is usually 90%.

Precious Metals or Crypto-Currencies? I personally own metal coins, but how do I spend them? I’ve owned mine for over 5 years, and they’re worth less now than when I bought them. And, if I sell, I have to pay someone a fee to buy them. And, where do I store them? Taxes are another issue, just realize that the government has their eyes on these things.

The result of all of these things is, uncertainty. We have no control over the markets, interest rates or taxes.

This subject is Think Long Range.

“Start with Why”

Simon Senek

Let’s look at WHY we store away money.

What do you ultimately want to happen?

- Protect your family from loss

- Save for retirement

- Grow your wealth

- Finance your purchases

- Create your legacy

All of these results are long range. They don’t happen overnight or in a few years.

What if you could accomplish all of those things using the same dollars? And, with more control and efficiency. You can if you practice Infinite Banking (IBC) utilizing dividend paying, whole life insurance.

Nelson always said, “Money has to reside somewhere.”

What better place than a permanent life insurance contract specifically designed for your goals?

What better way to guarantee that what you want to happen, will happen?

What better way to take control of the banking function in your life?

What better way to recover lost taxes, interest and fees?

What better way to create generational wealth and leave a legacy?

Practicing Infinite Banking and thinking long range by storing your money in permanent life insurance allows for all of these results with certainty.

If you want to know how you can use Infinite Banking in your family life or business, schedule a time for us to talk. Just follow this link to learn more and schedule a meeting: https://legacyinsuranceagency.com/ibc

Until next time,

I’m Barry Page, Your LIFE Evangelist

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps families take control of their finances and create financial independence.

Page has been cited on ABC, CBS, NBC and FOX for his work helping families and businesses with wealth building strategies to increase cash-flow, secure capital financing and provide tax-free retirement income.

Subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Find us and “like us” on Facebook:

https://www.facebook.com/legacyinsuranceagency