The Narrow Bank (TNB) Files Suit Against Federal Reserve

by: Lara Murphy Reporting

A recent article in Bloomberg explains that individuals representing “The Narrow Bank” (TNB) have filed suit against the New York Federal Reserve for refusing to grant them an account with the central bank. Although Fed officials cite vague “policy concerns” with the TNB business model, cynics think the explanation is very simple: the Fed doesn’t want outsiders to join the club of those eligible for its guaranteed interest payments.

Some background: Back in October 2008, soon after the fall of Lehman and as Congress was debating the TARP program, the Fed initiated a new policy of paying interest on reserves to commercial banks. That is, if commercial banks kept their deposits parked at the Fed, then they would earn a small but guaranteed interest return from the central bank.

In other words, just as taxpayers were bailing out the investment banks that had fueled the housing bubble, the Fed began paying commercial banks to not make loans to the general public.

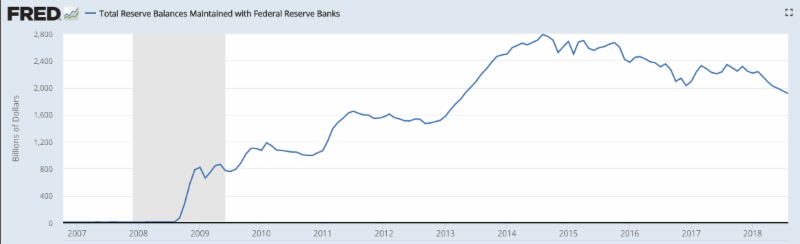

Over time, the Fed has gradually raised the interest rate that it pays on reserves. It is currently 2.2 percent. Keep in mind that because of the various rounds of “QE” (Quantitative Easing), the banking system has an enormous amount of reserves, which are the balances rolling over and earning this Fed-guaranteed rate. The following chart shows just how enormous the reserve balances have grown since the crisis struck

Notice that before 2008, the graph is so low that you can’t even see it.

Yet now, even though the total reserve balance has come down somewhat, it still stands at an enormous $1.9 trillion. Rolling over at 2.2%, that means the Fed is paying the bankers $1.9 trillion x 2.2% = $42 billion in guaranteed interest income at an annual rate.

In this context, “The Narrow Bank” was a proposal to open up a very simple financial institution that would take its clients’ deposits and park them at the Fed, where it would earn the (current) 2.2%. Then, after taking a small cut for expenses, TNB would pass along the interest income to its clients. In other words, the TNB proposal would open up the cartel of bankers to the broader financial community.

We hope you’re sitting down for this: The Fed rejected the proposal. And that’s why lawyers for TNB have filed suit, since the Fed hasn’t given a legal rationale for its refusal.

IBC Offers a Way to Secede From This Crooked System

We don’t have to throw up our hands in despair. Nelson Nash’s Infinite Banking Concept (IBC) provides a convenient, conservative method for households and businesses to design their alternative cash-flow management system. You can safely secede from the current commercial banking / Wall Street nexus.

Learn how IBC can work for you, schedule a discovery meeting.

Carlos Lara is CEO of United Services and Trust Corporation, a consulting firm specializing in business advisory services for privately held corporations.

Robert Murphy is Research Assistant Professor with the Free Market Institute at Texas Tech University. With Tom Woods he is co-host of the popular podcast “Contra Krugman.”