Cover Your Assets!

Retirement RISKS and How To Avoid

Running Out of Money During Retirement

Cover your assets from retirement risks. As far as I can see it, there are

3 Major RISKS facing Retirees:

- Sequence of Returns

- Uncertain Taxes

- Health and Long Term Care

There are many risks throughout life, but perhaps the one that plagues everyone during retirement, is the sequence of returns risk. Because it addresses the concern most people about retirement, the fear of running out of money. Compounded with the risks of a volatile market, this is enough to keep anyone up at night.

Here is what most people don’t understand about the stock market… We have been told our entire lives that the market goes up and the market goes down, but over time, it always goes up. And, because of “dollar cost averaging” it will all work out. ; )

Well, that is fine when you are in your 20’s and 30’s and focused on ACCUMULATION. However, it does NOT work for those in their 50’s, 60’s and 70’s who are retiring and DISTRIBUTING assets for income.

Accumulating wealth is much different than distributing wealth. And, this has everything to do with Sequence of Returns Risk.

We all know the stock markets are volatile, and that we “could” lose money. Unfortunately, many retirees learned this lesson the hard way during the 2008-2009 market crash.

Of course we were told that the markets will come back, and they have, but when will the next crash be? What happens then to people who are distributing their assets as income?

The reality of market returns is, timing matters. And, when withdrawing income from a market account that is losing value, timing is everything.

Before we go much further, there are a couple of myths that you may have heard, and should be aware of.

“You should buy term and invest the difference.”

The truth is most people never invest the difference. But, if they did… Many advisors have convinced them that they will earn 10-12% returns. This is almost laughable when you understand how financial professionals are allowed to legally hoodwink investors into believing this lie.

According to a report from well respected research firm, DALBAR, Inc., the average investor in asset allocation mutual funds earned only 1.85% per year over the last 30 years!!!

And the average investor in equity mutual funds averaged only 3.69% per year. And, that’s before fees, taxes and inflation.

The worst part is… The term insurance expires when you need it the most, at retirement. This was the case for my Dad, and 15 years later my Mother has very little income, because his term insurance ran out when it was needed.

“When you retire you’ll be in a lower tax bracket.”

Do you believe this? If you do, Robert Kiyosaki (Rich Dad Poor Dad author), says you are saying that you are going to be poor.

Inflation, the stealth tax, is eroding your money faster than you can save it, and your health is declining while you are getting older.

The irony about this myth is, if you are in a lower tax bracket, you’ll pay more in taxes one way or the other.

Tuesday Tip – CYA Video

Sequence of Returns during Retirement (distribution)

Pre-retirees and retirees who have a major portion of their assets in stocks and mutual funds, face the very real risk that the markets will drop as they are preparing to, or when they are withdrawing money from, those accounts.

If there is a market crash while approaching retirement, or in the first 5 years after, it can deplete your wealth and income rapidly.

According to Dr Wade Pfau of the American College of Financial Services. “Retirement is a difficult time for many people”, what happens during this “fragile decade” could have a debilitating impact.

If you suffer a significant loss of assets during this 10 year (fragile decade), it’s almost impossible to recoup the losses.

And, if this happens you’ll have a lesser amount to benefit from during any market recovery, over a shorter period of time.

This could mean having to cut back on your retirement lifestyle, or be forced to work longer than planned, or both.

I am NOT against equities. BUT, I am against having TOO MUCH money in equities. And, unfortunately there are too many people in that situation when they reach retirement.

Another report from the Economic Policy Institute (EPI) also found that many Americans are highly unprepared for retirement.

Many experts today say you should only plan on withdrawing a maximum of 2.8% of your retirement savings each year, for fear of running out of money.

And, using the old recommended withdrawal rate of 4%, you still have a 50% probability of running out of money over a 30 year period. (Morningstar Research Paper by Blanchett, Finke, and Pfau)

Would you board a plane knowing you only had a 50% chance of arriving at your destination safely?

So what is the solution?

It’s simple – Cover Your Assets and Invest in Yourself.

Make sure you have enough guarantees in your financial portfolio to cover you, and your distributable assets, even during bad times.

An Example of a Covered Asset at Retirement

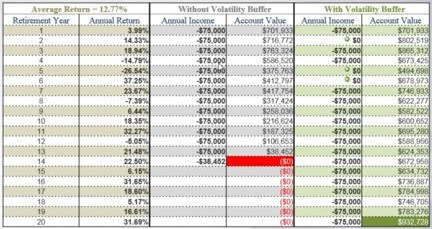

(The graphic is from Wealth Building Cornerstones and represents $750,000 in a retirement account. This is different than the $2,000,000 mentioned in the video, but the results would be the same. ($2,000,000 x 3.75% = $75,000). We do not want to assume you could withdraw 10% per year and have it last until mortality, but that is the point, you will run out of money.)

We are assuming someone has $750,000 in an account and will use a 10% withdrawal rate for income of $75,000 per year.

In the left column we have 20 years of market investing yielding an average return of 12.77%.

In the middle column you will see they ran out of money completely during the 14th year. Depending on how old someone is at this point, it could be devastating.

The right column illustrates what would happen if this person had another account acting as a volatility buffer in the years the market had losses. That way they could withdraw income from the covered asset account instead of the market account.

Cover Your Assets

Think about it: we cover our cars, our homes and other assets. But many people feel like they won’t “need” protection when they are retired, because they’ll be self-insured.

You may not need it… But you’ll probably want it.

We can not control the ebbs and flows of the markets. So, having our wealth held in assets that are not correlated to the markets can be critical to having predictable income during retirement.

Permanent Life Insurance is a Financial Tool

What is the value of having an asset that not only provides income for retirement, but also combats risks and the other eroding factors of wealth?

Permanent life insurance is an asset that is hard to value. You can’t really compare it to other assets like stocks, bonds, mutual funds, precious metals or even real estate.

But, it can make those other assets better. So, the reality is, we need to cover ourselves as assets first.

I’m not just talking about any off the shelf life insurance, I’m talking about a Custom Designed Dividend Paying, Participating Whole Life Insurance Contract from a Mutual Insurance Company

Remember, You, are the asset! We should be protecting ourselves first, then we can protect our other assets with additional coverage.

Think about banks, they protect their assets with insurance. And they make us protect our assets first, BEFORE they will loan us any money to purchase those assets.

If I can help you in any way, just let me know. Schedule an introductory call.

I appreciate your likes and comments, and would really love it if you subscribed to our pages and our email list.

Until next time, CYA!

Barry Page, RFC

LIFE Evangelist

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps families take control of their finances and create financial independence.

Page has been cited on ABC, CBS, NBC and FOX for his work helping families and businesses with wealth building strategies to increase cash-flow, secure capital financing and provide tax-free retirement income.

Please subscribe to our YouTube channel:

https://www.youtube.com/user/legacymoney

Find us and “like us” on Facebook:

https://www.facebook.com/legacyinsuranceagency