College Funding Commitment

While students are following an ever evolving curriculum from grade school, middle school and high

school in preparation for the next level in their education, many parents are recognizing that they are illprepared for the financial commitment that most higher education pursuits will require.

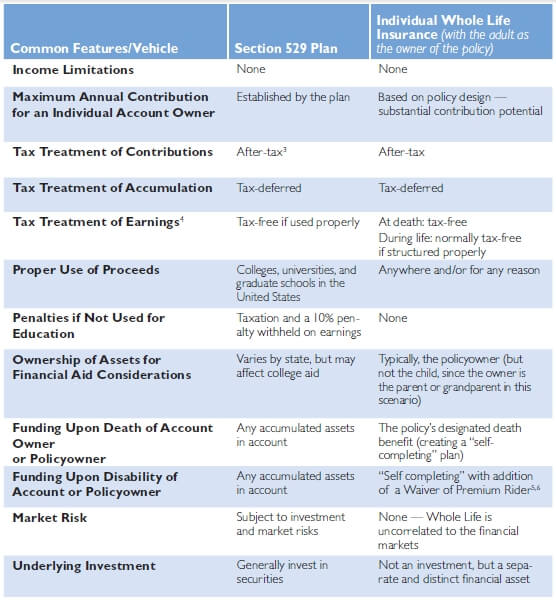

Even if you began saving at the birth of child, you may find that many of the pre-paid tuition plans have

fallen short of their financial promises and unfortunately some have even ceased to exist. 529 plans which

offer tax free withdrawals for education costs have suffered the fate and turmoil of the investment markets and as a result often have little more available than the value of their contributions.

Timing

The timing of college does not seem to come at a convenient time for us either. The expense of college

typically occurs just a few short years before we have to begin facing the end of our working career and

the uncertainty in today’s world of retirement. Add the fact that retirement is fast becoming an illusion

rather than a reality due to recent market turndowns the economic climate has positioned many parents

with two major financial objectives vying for limited and perhaps insufficient funds to achieve either

objective.

Students today are following a well rounded educational path to prepare for academic and professional

pursuits upon graduation, however parents have been left alone to prepare for the financial burden their

child’s educational pursuits will demand. When you consider the expense to even raise a child today it

is no wonder than many have had little resources to put towards college expenses.

Regardless of how late or early in the game you started planning there are specific steps and approaches

that should be followed in order to ensure that you maximize the opportunities available and are prepared for this major expense when your child is ready for college.

Steps for College Preparedness

First, the entirety of the probable timeline for your child’s higher education must be documented.

Undergrad and perhaps graduate training. Getting them in is only the beginning, you also need to be

prepared for the long road in getting them out and then into the work force.

Second, an accurate forecast of available resources for all your financial goals should be established.

When you fully understand the entirety of your financial resources including your present income, savings, and borrowing capacity, you can more adequately prepare a funding plan that is going to work and provide the maximum financial opportunities available.

Third, it is important that you spend time prioritizing all of your financial goals. In addition to the future

expense of college you must also cover the cost of living today as well as prepare for your retirement.

Fourth and finally, we recommend a year by year plan that incorporates all your financial goals with as

many guarantees along the way as possible. The difference between planning and wishing lies in the

commitment to ensure the outcome.

College Decisions

If you are feeling somewhat overwhelmed with the demands of being ready financially for your child’s

college expenses you are not alone.

Do you remember playing Tic Tac Toe as a child? Who won the first time you played? That’s right the person who showed you the game. You learned the rules as you played and lost regularly until you

figured it out.

The financial rules related to college planning are difficult, and if you try to learn as you go you may find that you can make some pretty big financial mistakes along the way. We can help with the rules and can potentially help you find money that is available to you and your child that you could have missed.

Schedule a review and allow us to help you make sure your child is not ready for college before you are.

MoneyTrax’s College Funding Video

Your financial education may be more important than college. Shop our bookstore to expand your knowledge.

Subscribe to our YouTube Channel@legacymoney