What is the True Cost of College?

The Economics of College

As a student currently enrolled in college, I’d like to offer parents a perspective that they may not have heard about putting their kids through secondary schooling… And that is, what is the true cost of college?

We’ve all been taught that getting your children to college is a necessity. The argument is that the average college graduate earns more in their lifetime than the average person who does not graduate college. But, there are other things to consider, and a college degree may be overvalued.

See, many children grow up learning that getting to college means success. Their teachers, counselors, and parents all tell them this. And by high school, a lot of kids are thinking about school as a period of life that you just have to endure, as opposed to appreciating the opportunity to learn. So, of course college is going to be the same way.

What Does it Take to Earn a College Degree?

“C’s get degrees,” is something many college students live by. Why focus all of your attention on learning course content, when you can do the minimum to get by? The student who parties every night and crams for exams the night before is most likely going to end up in the same position as the student who tries their hardest on every assignment. Does that mean that the first student is going to be as prepared on the job as the second? Do you think that the employer who hired the first student will continue to place as much value in potential employees just because they have a degree?

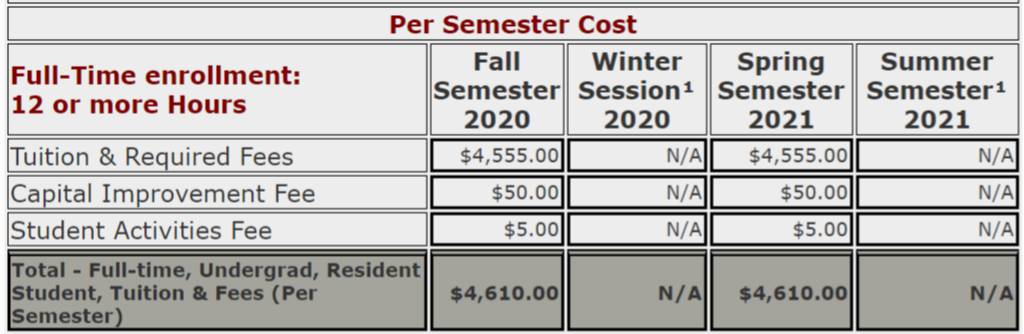

*Above is the cost of tuition per semester at my school (for in-state). $4,610 per semester equals $9,220 per year. So tuition alone will cost you $36,880 for four years.

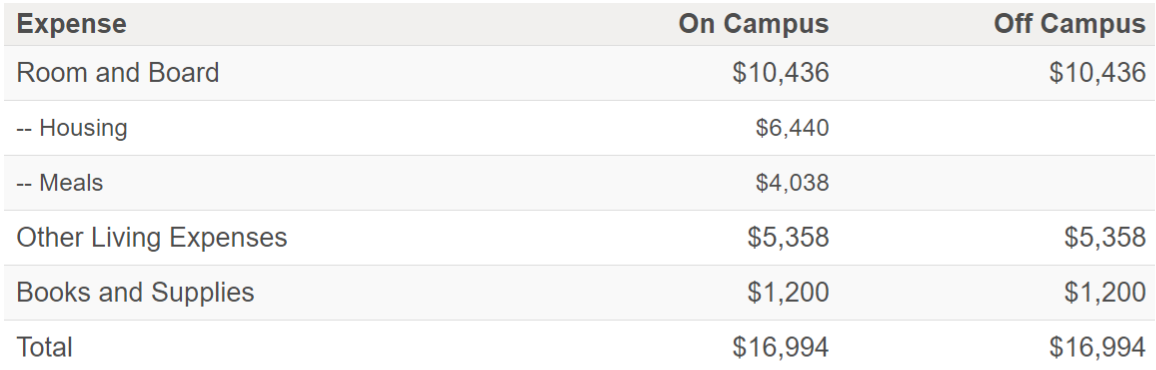

Add on another $17,000 per year for living expenses, and now you’re up to $105,000 — just for four years.

Is a College Degree Required?

I’m currently studying Computer Science at my university. While finding potential jobs may be easier with a degree, as you gain experience, the playing field begins to level out. In fact, in a 2016 survey by Stack Overflow, 56% of software developers responded that they did not have a college degree. They also found that over 60% of job listings on their site did not mention having a degree as a requirement.

Something that is true for many career fields, and especially software development, is that a degree is not enough. Employers are looking for people that are passionate about what they do, and a piece of paper doesn’t always prove that, as explained above. So gaining real-world experience to do a job well may be more important than spending four or more years in the bubble of a university.

So, when you consider the ever-increasing cost of college tuition along with the decreasing value of a degree, you may start to question if sending your child to college is the right choice.

In a future blog we will compare the cost of college to employment income, and business profits.

Until next time,

Ethan

Future College Graduate