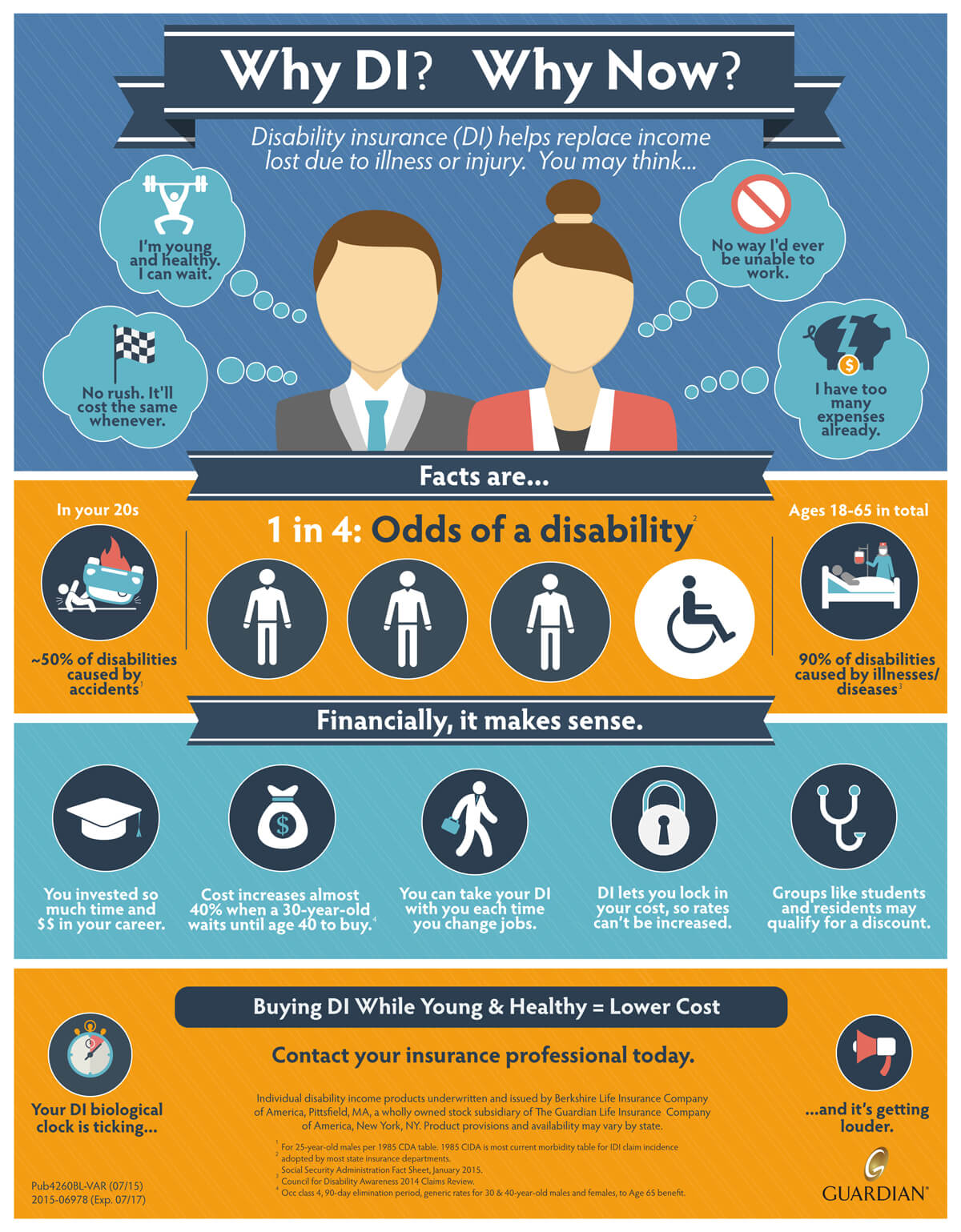

Why Disability Insurance (DI)? Why Now?

Why Disability Insurance (DI)? DI helps replace your income due to illness or injury.

You may think you don’t need it or can’t afford it, but the facts say otherwise.

- One in four will suffer from a disability at some point in their lifetimes.

- For younger people, fifty percent of disabilities are caused by accidents.

- For older people, ninety percent are caused by illness or disease.

Disability Insurance Protects Your Income

Financially, owning disability insurance makes sense. You’ve invested time and money into your career. Why not protect your income?

When you own individual DI, you can take it with you when you switch jobs. The sooner you purchase DI, the sooner you can lock in your rates. Rates can increase dramatically as you grow older. Your biological clock is ticking, don’t delay, get disability insurance today!

For Professionals and Employees

Professionals such as medical specialists and physicians will want to consider long-term disability insurance with a pure own-occupation definition of total disability, with medical specialty language to age 65 or longer.

Employed persons with annual incomes under $40,000 may want to consider simplified issue Disability Insurance plans. These products feature simplified issue underwriting, and requires no exams or labs on the part of the applicant, allowing for the insurance company to heavily discount the premiums because of the substantial savings from the lack of usual underwriting costs.

Until next time, Protect Your Paycheck!

Barry Page, RFC

Registered Financial Consultant®

Bank On Yourself® Authorized Advisor

Infinite Banking Concept® Authorized Practitioner

P.S. Even if you’re already own DI at work, you may want to review your plan.

Barry Page is recognized as a leading expert on insurance and private banking. He is a an independent insurance agent who helps clients with investment alternatives. He specializes in private family banking and coaching others on the Infinite Banking Concept®.

*DI Infographic from Guardian Life

*Statistics from Social Security Administration