5 Steps to Financial Independence

How To Create Wealth and Freedom

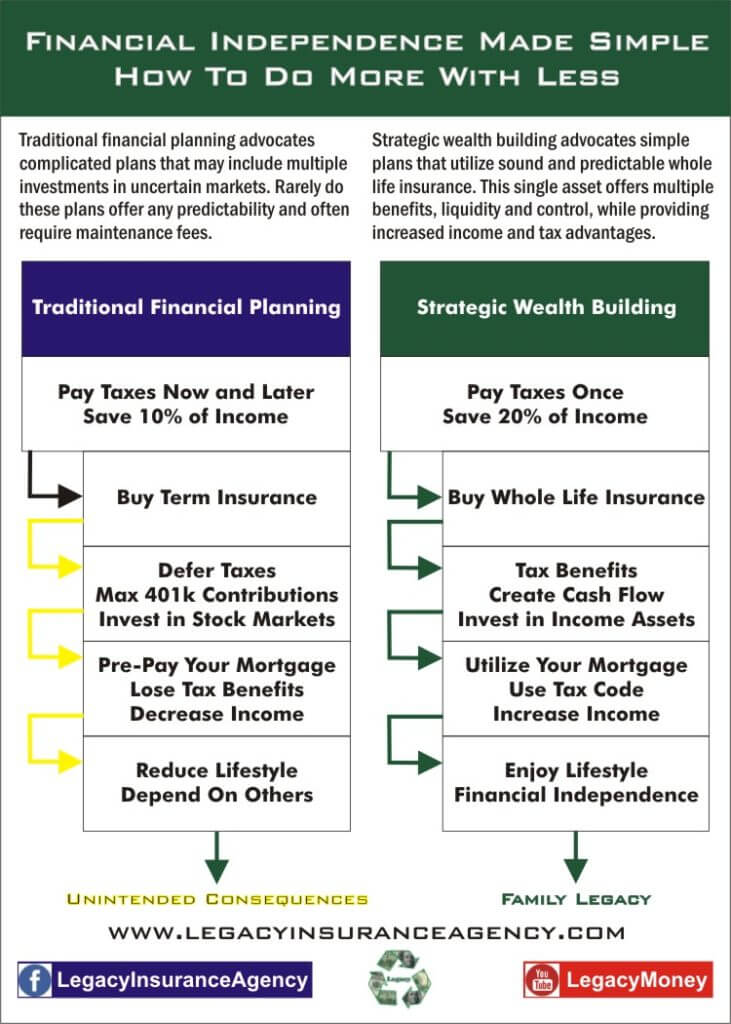

Financial independence is truly that, freedom to do what you want on your schedule without depending on the banks or government. But, what if everything you’ve been taught about money and finance wasn’t true? That’s a bold statement, but when you realize that the deck is stacked in favor of the banking system and the government, you can start to understand.

If What You Thought to Be True Turned Out Not To Be

How you create and store your wealth is your decision. Unfortunately, we’ve been told since birth to…

- Work hard – get an hourly job as soon as you can

- Go to school – finish grade school, college and maybe get a graduate degree

- Get a good job – trade hours for dollars and look for benefits like healthcare and retirement

- Save – contribute 10% or more to your retirement account (IRA, 401k, ROTH, SEP ie IRS Qualified Plans)

- Defer your taxes

- Prepay your mortgage

- Buy term and invest in the stock markets

- Retire – when pension plans dictate

- 59 1/2 for qualified plans, 65 full benefit Social Security

- Reduce your lifestyle, depend on others

So, our decisions on how and where to store our wealth have been corrupted. Unfortunately, these rules and steps were created by the elite, the financial institutions, and the government who enforces them. : ( (Don’t follow those steps)

A Better Way

The good news is… You can change all of that and escape the tyranny. You can begin to enjoy the freedom of financial independence by investing in yourself and your family. It’s your choice!

Where you store your wealth is much more important than the return that it earns. While most Americans are dazzled into believing that they should “invest” in certain financial products with certain financial institutions, they are foregoing their own best interests.

To borrow a cliche, think of it this way. If you had a golden goose that laid golden eggs, would you protect the goose from predators? Of course you would… You are the goose!

Protect What’s Really Important

When you’re auto and home are required to carry insurance, it’s not really to protect you from loss, it’s to protect the financial institution that loaned you the money. But, there’s another kind of insurance that can not only protect you from loss, it can protect your money from predators. All the while this specific kind of life insurance allows you access to capital throughout your lifetime and for your family after you’re gone.

So, now that you have the protection part down, let’s talk about finance because cash-flow is what gives us the freedom to do what we want, when we want.

We’ve been taught that debt is bad, and it can be, but you can also use it as a financial tool if you know how. The important thing is to be in control of the terms of the agreement. When you control the banking function, you can determine the terms and make decisions based on your particular circumstances at that time.

Nelson Nash, author of Becoming Your Own Banker, said “You finance everything you buy, you either earn interest or pay interest to others.” In his book Nash outlines how you can use the banking function of a traditional whole life insurance policy to finance your major purchases over your lifetime.

By utilizing The Infinite Banking Concept the families and businesses can recover interest costs they normally would transfer away. This strategy alone can mean millions of dollars to the bottom line of the average family and keep that money in the family.

Creating Wealth

Great wealth is created by being effective and efficient with your finances. Most self-made millionaires did this in business. Surveys show that he majority of American’s would like to own their own business, but fear keeps them from doing so. There is fear of loss, fear of being successful, fear of failure, etc. But, when you look at successful businesses, there are certain types that have an excellent track record. They follow a proven model, usually franchises.

The Family Business

When you think of starting a business, what if all the fear could vanish because you were using a 200 year old proven model based on actuarial data? What if you were in business with other like-minded, healthy individuals that loved their family, and where each owner controlled their own terms? This Family Bank Business already exists, and if you qualify you can buy in at the level you want!

Whole life-insurance is the financial tool that I’ve been describing. However, it is important that you purchase the right kind, as their are many imitators in the marketplace promoting themselves as whole-life. Infinite Banking and Private Reserve strategies work best with participating, dividend paying, whole-life insurance from a mutual life insurance company. There are only a handful of companies that offer these types of policies and you will want to make sure your agent knows how to build these policies properly, and owns them himself.

Retirement Planning

Ultimately, we save, invest or create assets in order to someday be able to live off of the income those assets can provide. The difference here is that some of these assets will produce more cash-flow at retirement than others because of uncertainties like taxes and the risk of loss.

Distribution is much different than accumulation, so during retirement we should carefully consider assets that can not lose value during harsh economic times and are not subject to taxation.

How To Create Financial Independence

If you practice these steps, financial independence is simple, and you can do more with less. Typical financial plans are difficult to understand and based on products and variables that you have no control over. Once you discover that you can utilize your God given talent to increase your wealth and cash-flow, you’ll know what to do.

- Work Hard and Play Hard – experience life in different occupations to find your passion

- Self Educate – whether home school, private school or by personal reading, keep learning

- Start a Business – even if part-time, test your skills, learn a trade and earn profits

- Save More – save on your own, and invest in income producing assets

- Pay taxes on your income once

- Utilize your mortgage for as long as possible for protection and benefits

- Buy dividend paying, whole life insurance customized for your situation

- Retire – on your terms without depending on government plans

- Create passive income that does not require physical labor

- Enjoy your lifestyle and die on your terms

- Pay off your debt with your dead self

- Leave a financial legacy of stewardship

The Simple Plan

What I’ve just outlined for you is the simplest, most effective way to create generational wealth and financial independence. It all begins with education, and it really doesn’t matter where you are in life. It doesn’t have to be complicated and the only person you have to depend on is you. You can start today!

If you liked this post, please comment and share it with others.

If you’d like to learn how to create wealth and cash-flow in your life, follow this link for a personal financial review.

Until next time,

Barry Page, RFC

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps clients with tax-advantaged investment alternatives, and specializes in showing families how to protect their assets, income and lives unique financial approach to planning.