401k Exit Strategy

How To Spend and Use Your Retirement Income Effectively

It often astounds me how many people really don’t have an exit strategy for their 401k. And, I mean a money solution, an effective plan to use and spend their retirement efficiently, to reach their desired goals.

So, I’d like to share with you a little known, but time tested strategy that is usually reserved for the wealthy. It’s also used by the world’s largest banks and corporations.

IRA/401k Distributions (Withdrawals)

A 401k withdrawal or distribution is how you take your money from the account, which has rules and restrictions. We’ll assume you are taking the distributions when you retire, or after age 60.

There are 2 main types of 401k Withdrawals we’ll consider, taking 401k Distributions during retirement and Required Minimum Distributions (RMD’s).

While traditional financial advocates encourage these inefficient plans, they rarely offer advice or an effective strategy for taking withdrawals. They want you to extend your retirement, possibly in a stretch IRA, or even as an inheritance, as long as there’s a management fee.

Furthermore, what advice they do offer early on focuses on how to avoid the common 401(k) fees and taxes, but there’s really no way around them.

IRA Rules and Penalties

If you withdraw money from your 401(k) account before age 59 1/2, without a special situation you will have to pay a 10% early withdrawal penalty, in addition to the income tax on the distribution.

And, according to IRS rules, if you don’t take your required minimum distributions by age 72 1/2, you’ll pay a 50% penalty.

Taxes

Obviously, being aware of 401k withdrawal rules can save you from making costly mistakes. However, the plan itself was a problem since the beginning, and you may have never been told.

That’s what you signed up for… But what really matters is that your retirement could be further decimated because of unnecessary fees and taxes.

While taxes were deferred, they also compounded with the growth of the account. And, if you are successful the chances are you will be paying taxes at a higher rate than when you deferred them.

The important thing now is knowing how to take your money wisely and protect it, while maximizing your spendable income.

So, what can a person do? That’s a good question… and here’s my 5 best tips for wisely planning, managing and spending retirement savings.

5 Wise Tips for Planning and Spending 401k Retirement Savings

1. Imagine your ideal retirement, and then determine an estimate of your spending or expenditures. Consider obsolescence and technology.

2. Secure your assets by preparing for unexpected events such as long term care and even death. Medical costs can destroy wealth.

3. Secure your income with predictable income streams. Consider tax law changes and inflation.

4. Store your money where it is safe, liquid and protected from creditors and lawsuits. Consider the time value of money, risk and volatility.

5. Protect your legacy and coordinate beneficiaries with other estate plans. Consider estate taxes and legal fees.

Ideal Retirement Plan

Once you have your ideal plan in your mind, you can take action and live your retirement with less risk and worry.

You’ll have to find a place to store your money, a Warehouse of Wealth, that can provide you with the results you want to accomplish.

There are very few storage places that can offer the many benefits of whole life insurance and the opportunity to create financial independence.

How can life insurance help during retirement?

This question comes up often…

Life insurance is a private contract between the owner and an insurance company. In exchange for a payment, the insurance company is legally obligated to provide you with benefits pursuant to the contract.

Specifically, these benefits can be utilized to pay expenses for long term care, as a hedge against inflation, and as a regular, predictable, and reliable income stream for life.

The Secret Benefits of Life Insurance

Perhaps the best kept secret of permanent, dividend paying, whole life insurance, is that it can be used to provide a steady, tax-exempt stream of income during retirement.

Can a 401k Rollover to Life Insurance?

The short answer is No… and you wouldn’t want to.

The 401k is a part of the IRS tax code, and therefore they control it, and their rules can change. Financial independence starts with control, life insurance is a private contract typically owned by the policyholder.

You can withdraw or take distributions from a 401k. And, if you’re past age 59 1/2 there is no penalty. You will have to pay the taxes, but you were going to have to do that anyway.

If you are retired or nearing retirement, the time to plan and act is now.

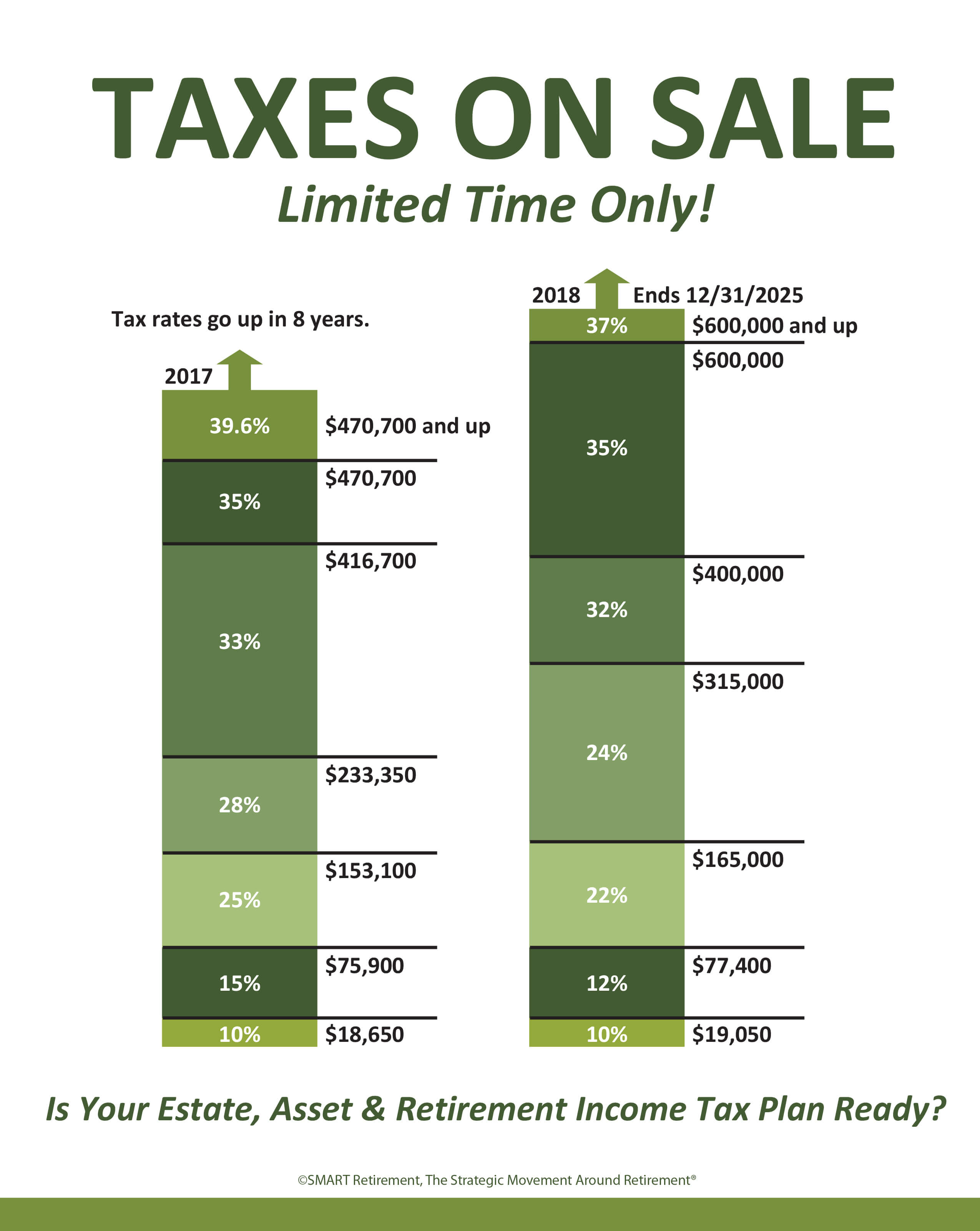

Right now you may consider taxes as being on sale. What happens in the future is anybody’s guess.

Structured Plan for Your 401k

You can be SMART with your retirement, and maximize your benefits and income with a properly structured 401k exit strategy. The banks and government have their own rules, so abide by them, and plan your exit into a plan that you own and control.

How To Overcome the 4% Rule with A Volatility Buffer

Instead of taking risks and guessing about withdrawals and timing, you can add certainty to your retirement plan. Tradtional financial plans depend on a monte carlo approach that uses a 4% withdrawal rate.

The 4% rule says that you can “safely” withdraw four percent of your investment each and every year during retirement, without the fear of running out of money. Should a withdrawal of say 6% be taken during a year when the investment received a negative return, the principal could be reduced.

When used in conjunction with whole life insurance, withdrawals can be increased or not taken at all, because the life insurance can act as a volatility buffer during market down years.

Life Insurance Can Add Certainty To Your Retirement Plan

Whole life insurance and can help you guarantee that what you want to happen will happen, including having more spendable income during retirement. With this tried and true financial product, you can rest assured knowing that you and your family are protected, regardless of what happens in the stock markets.

Life insurance can provide protection and growth with certainty. A traditional whole life policy from a mutual company also offers dividends. Though not guaranteed, most mutual companies have a 100+ year track record of paying dividends to their policyholders each and every year. These life insurance policies can be structured in many ways to help you reach your financial goals.

If you’d like help in executing your 401k exit strategy, contact me for a quick introductory call or a complete financial review. I want to help my clients create financial independence without the banks and government, so they have control of their money with less risk and worry.

Until next time,

Barry Page, RFC

Barry Page is a Registered Financial Consultant, Managing General Agent and Founder of Legacy Insurance Agency, PLLC. He helps clients with tax-advantaged investment alternatives, and specializes in showing families how to protect their assets, income and lives using a unique financial approach to planning.

Disclaimer: We do not provide investment, tax or legal advice; and accept no liability for the information we provide. Contact your tax advisor.

Subscribe to our YouTube channel: https://www.youtube.com/user/legacymoney

Find and Like us on Facebook: https://www.facebook.com/legacyinsuranceagency