Economic Freedom

Today our economic freedom has been stolen… in the name of FEAR.

Freedom and Security are inconsistent. Freedom of choice, is in contrast to the freedom from choice. This amounts to Tyranny.

The following is a republished article from 1960 entitled Freedom of Choice. It holds true today as our options for medical care are being limited, enjoy the read.

Arthur Kemp, Ph.D., is Director of the Economic Research Department of the American Medical Association. This article is reprinted by permission from the February 27, 1960 issue of The Journal of the American Medical Association.

At Atlantic city in June, and again at Dallas in December, the American Medical Association’s House of Delegates proclaimed and reaffirmed the belief that the “free choice of physician is the right of every individual” and that such freedom of choice, together with free competition among physicians, constitute prerequisites to “optimal medical care.” In so doing the House of Delegates, by inference, took a position in favor of individual freedom of choice in general and expressed a preference for maintaining a social, political, and economic framework in our society conducive to the preservation of such freedom of choice.

All too frequently the term freedom has been misused or abused. Perhaps this is inevitable when the concept of freedom is capable of stirring up considerable emotion in the human breast; indeed, some men have died for it, and many others have proclaimed their willingness to do so. Less often, however, have men had the patience to devote attention to the less emotional and more mundane restrictions on freedom when these do not directly affect them. Certainly it behooves members of the medical profession to give attention to the broader meaning of the term “freedom of choice” and to its implications.

If freedom of choice were to relate merely to the number of courses of action open to a person, it would be more accurately described as power of choice. But freedom of choice represents something more fundamental than power; it represents the right of the individual person to be a free agent in his interhuman relationships, to make his own decisions, to be free from the arbitrary authority of others, and to be able to choose how he wishes to use his services or property rather than to be subject to coercion by others. Freedom of choice means that the the person is able to choose his own course of action and his own pattern of living, subject to the requirement that he shall not act so as to violate the freedom of choice of others.

Freedom in this sense, it should be noted, is freedom of, not freedom from or freedom to; the preposition is of great importance, for the latter represent not different aspects of the same thing but entirely different conditions. This calls to mind the famous four freedoms enunciated by President Franklin D. Roosevelt during World War II—freedom of speech, of worship, from want, and from fear—later called “a noble pun” by the British economist, Joan Robinson. The two pairs of freedoms were, in fact, of entirely different character. Mr. Roosevelt meant security from want and fear, not freedom or liberty. Many philosophers, including Franklin and Jefferson, have pointed out that freedom and security are inconsistent human conditions. Indeed, make freedom of choice into freedom from choice and one comes close to a definition of slavery.

A Vital Distinction

The struggle and debate of our time is intimately related to this difference between freedom of choice and from choice. Such a difference relates to the alternative methods of organizing human activity and is not simply a struggle between the United States and the

Soviet Union or between the free world and the unfree world. Human activity can be organized so that the individual person has freedom of choice or so that he has little or no choice. The latter is the technique of the totalitarian state while the former is the mechanism of the market place with limited government and the separation of political powers.

A freedom-of-choice society in the economic sphere is a market society. Individual economic transactions are conducted through the voluntary cooperation of reasonably well-informed persons in such a way that both parties benefit from them. A free-choice society provides a mechanism for bringing about coordination with a minimum of coercion. Human activities, so far as possible, are conducted in the market, not in the political sphere. In this way coercion of individual persons to conform is minimized and freedom of individual choice is maximized. Each person can choose the color of tie he wants, the architecture of his house, and the cut of his clothes. He does not have to submit to what the majority wants; he may make his own choice and get it.

This is, of course, exactly the opposite from that organization of society where decisions which could be made by the market are made on a political yes or no basis. Even if these decisions are reached by the expedient of democratic majority rule (which may be transitory) rather than by dictatorial fiat, the political decisions are the results of group pressures instead of individual choices.

We live in a society still essentially free, one that gives to the individual person the right not only to choose his physician but to make other choices as well. Indeed, we have even permitted the individual person to choose to use his capital and his services to advocate the abolition of freedom of choice itself. Throughout the history of mankind this sort of society has not been the general rule but the exception. Perhaps this is inevitable. The totalitarian collectivist principle is simple and straightforward; it appeals to those who say, “Do something now.” The necessity of restraint, group and individual, the recognition of ignorance and the imperfection of human knowledge, and the denial of a millennium and the aim of establishing conditions that make life not perfect but workable—all these attributes of a free-choice society constitute a highly sophisticated doctrine.

It is sobering to see the growing number of so-called leaders of political thought or politicians who advocate an ever-growing governmental assumption of responsibility for all sorts of complex economic and social problems—full-employment, care for the aged, care for the indigent, government health services, subsidized housing, and so on and on. Yet the moral ethic on which our civilization rests emphasizes individual responsibility. Can such a civilization survive? Perhaps, but only if it recognizes the difference between freedom of choice and freedom from choice.

Ideas on Liberty

“Freedom” From Responsibility

WHEN the Athenians finally wanted not to give to the State, but the State to give to them, when the freedom they wished most for was freedom from responsibility, then Athens ceased to be free and was never free again.

EDITH HAMILTON

***

This article was originally published on FEE.org. Read the original article.

Who Needs Disability Income Insurance?

Infinite Banking Savings System

Family Banking Master Class

How To Prepare for Risks and Uncertainties with Life Insurance

5 Smart Ways to Spend Your Tax Refund

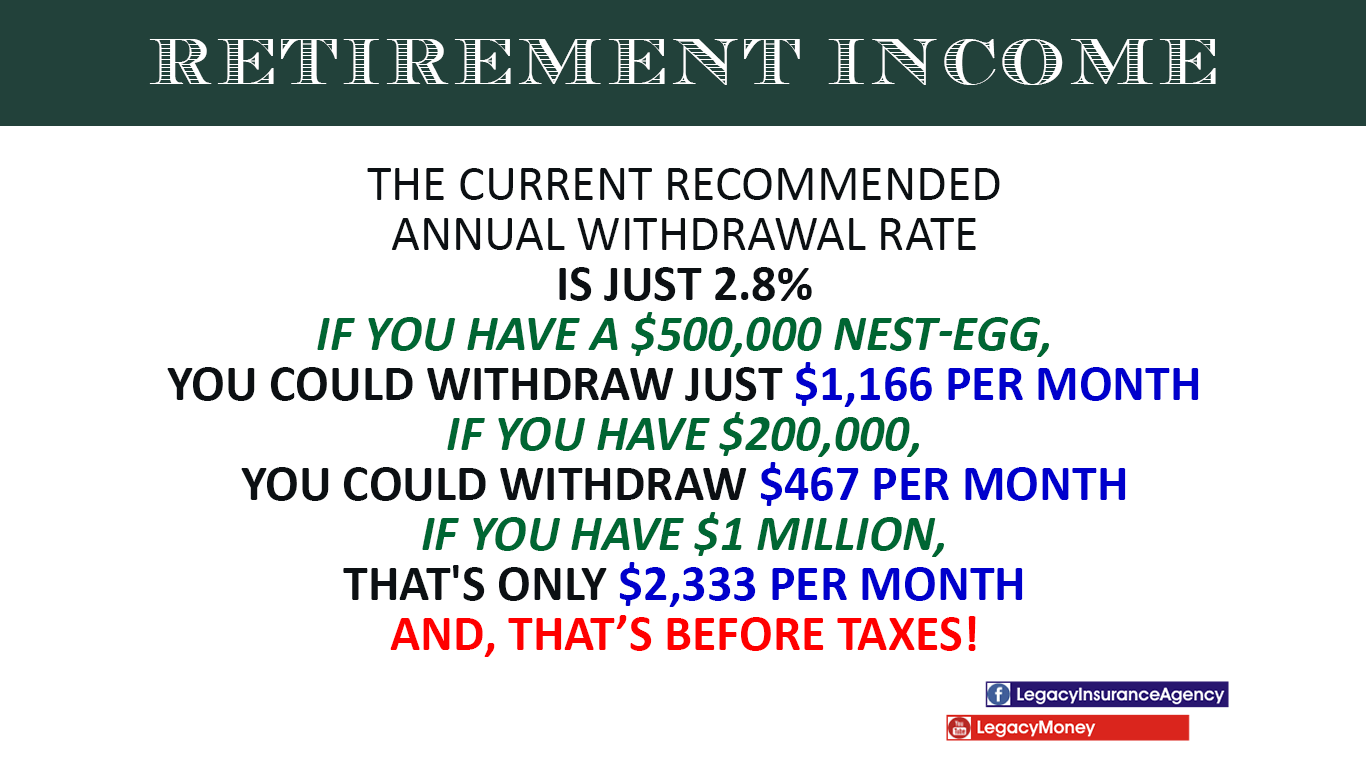

Retirement Savings

Best Disability Insurance for Physicians

Retirement Income Distribution – How To Retire with More Spendable Income

Cash Value, Whole Life Insurance for Today

Retirement Planning with Life Insurance

Legacy Money Live

Risks of Disability

Banking Is Important…

Economic Freedom

Protect your economic freedom, schedule a financial review.